You’ll find that most cards that offer a significant sign-up bonus also carry an annual fee. I currently have over 25 credit cards in my wallet; at least half of those have a yearly fee! I understand it can feel counterintuitive to pay a bank to use their credit card. However, many of these cards offer perks and benefits that far outweigh the annual cost. Let’s review these fees and discuss why it’s important to keep an open mind regarding annual fees.

What is an Annual Fee?

A credit card annual fee is a fee charged by the credit card issuer each year for the use of the credit card. It is a fixed amount that you, the cardholder, must pay annually to keep the credit card account open.

Why Would I Want a Credit Card with an Annual Fee?

Cards with an annual fee also come with perks and benefits that generally outweigh the cost of the card. Let’s break down one example…

One of my favorite cards is the Alaska Airlines card. The cost of this card is $95 per year. However, on top of the initial sign-up bonus, the card also comes with the following benefits:

I use the companion fare yearly to purchase airfare from San Diego to Costa Rica. My ticket is usually around $700 roundtrip, and I get a companion ticket for $99 plus taxes (generally around $40). So, in this case, that companion ticket costs me $140 for a $700 flight.

My $95 annual fee has saved me $560! The Alaska card also includes one free checked bag for everyone on the reservation. We usually travel with surfboards to Costa Rica, and this perk saves us hundreds of dollars each way. This is an excellent example of the perks of a card outweighing the cost of holding the card.

Aside from the initial sign-up bonus, here are some standard perks you might find on a card with an annual fee:

Branded Airline Credit Card Perks

Airline credit cards that carry an annual fee will usually come with some combination of the following benefits:

- Free checked bag

- Priority boarding

- Passes to airline lounges

Branded Hotel Credit Card Perks

Hotel credit cards that carry an annual fee will usually come with some combination of the following benefits:

- Late checkout

- Hotel status

- Annual free night’s stay

Luxury Credit Cards

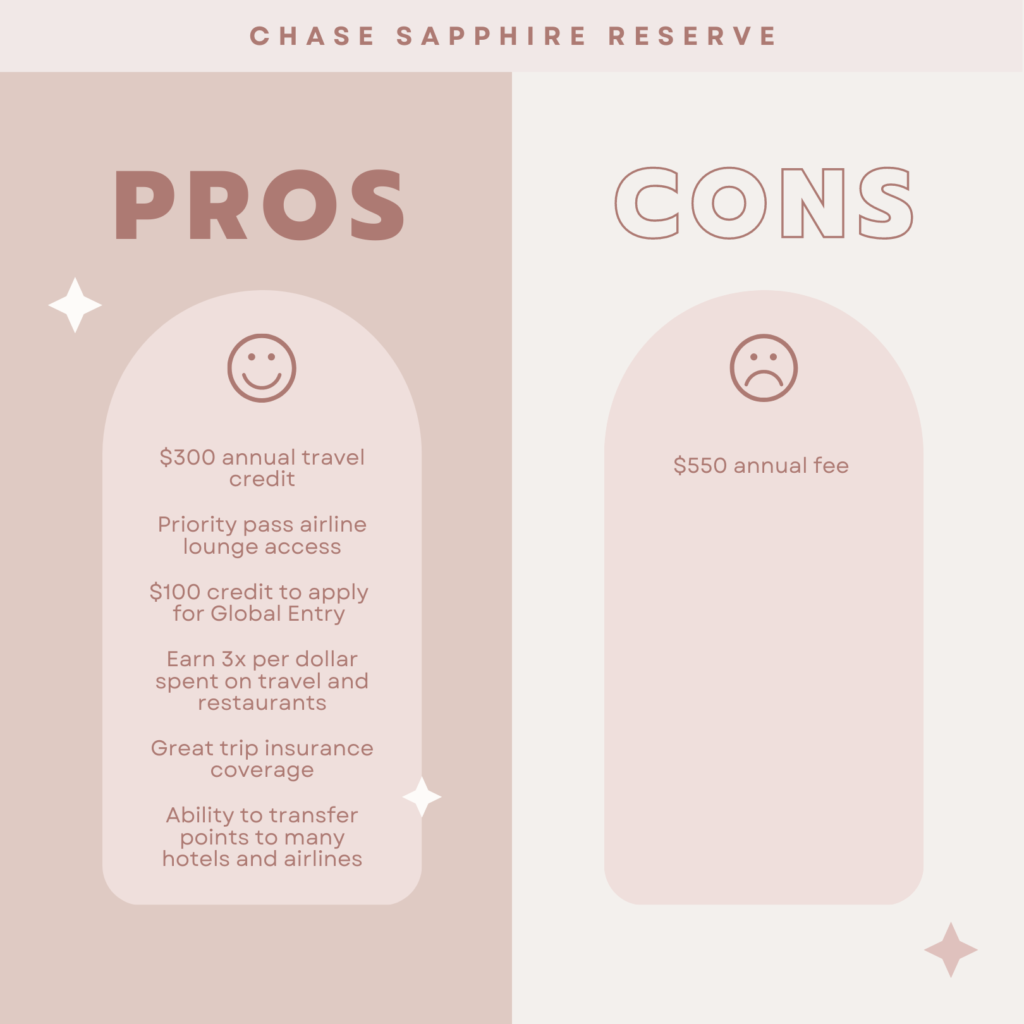

Most luxury credit cards carry pretty hefty annual fees. I understand if your initial reaction is to balk at these high amounts. But their perks are so great that you can often recoup the cost if you use all the card’s benefits. Here’s an example of one of my favorite luxury cards:

As you can see, the $550 annual fee on the Chase Sapphire Reserve card is NO JOKE. However, it comes with a $300 annual travel credit and a $100 global entry credit. Assuming I use both of those in a year, the annual fee is more like $150.

Now, I add the priority pass lounge access, which my family of four uses before almost every flight. The lounge access is a game changer for us. It’s an opportunity for a space outside the hustle and bustle of the airport. The boys grab snacks, and my husband and I usually have a glass of wine, cheese, and crackers. THIS.IS.ALL.FREE. Honestly, this lounge access is worth its weight in gold to me.

Another great perk is the travel insurance offered by the Reserve card. A few times, I have filed claims due to delayed flights, and Chase has reimbursed me for hundreds of dollars worth of meals, extra car rental time, etc.

Now, things that I value enormously may not be things that you value. This is why it is essential to reassess your cards every year when your annual fee comes due. Do the benefits outweigh the cost for you? If you are squeezing maximum value out of the card – it’s a keeper! If you can’t justify the cost, it’s time to cancel or downgrade.

Conclusion

While it may seem counterintuitive to pay for your credit cards, the benefits of the cards can far outweigh the cost and end up being handy tools in your wheelhouse of free travel.