You have likely spent most of your adult life hearing about the importance of the illustrious credit score. And for a good reason! Your credit score can determine whether or not you snag a lease at a new apartment. It can determine whether you get a reasonable interest rate on a new car. Regarding reward travel, a good credit score makes a huge difference in the types of cards you can get approved for and, therefore, the types of sign-up bonuses you can earn. Also, travel hacking aside, understanding your credit score is one of the first steps to being financially literate- a skill set that women have been locked out of for years (annoying, I know). So, let’s break down how a credit score works and how to ensure yours is in tip-top shape.

What is a credit score?

Your credit score is a number used to represent your creditworthiness. Creditworthiness is a fancy way of saying how likely you are to pay your debt back on time. This credit score is used by banks, credit card companies, and mortgage companies. The most widely used credit score model in the United States is the FICO score, which ranges from 300 to 850. The higher your score, the better, as it indicates to banks that you are at a lower risk of defaulting on a loan or credit card payment.

How is a credit score calculated?

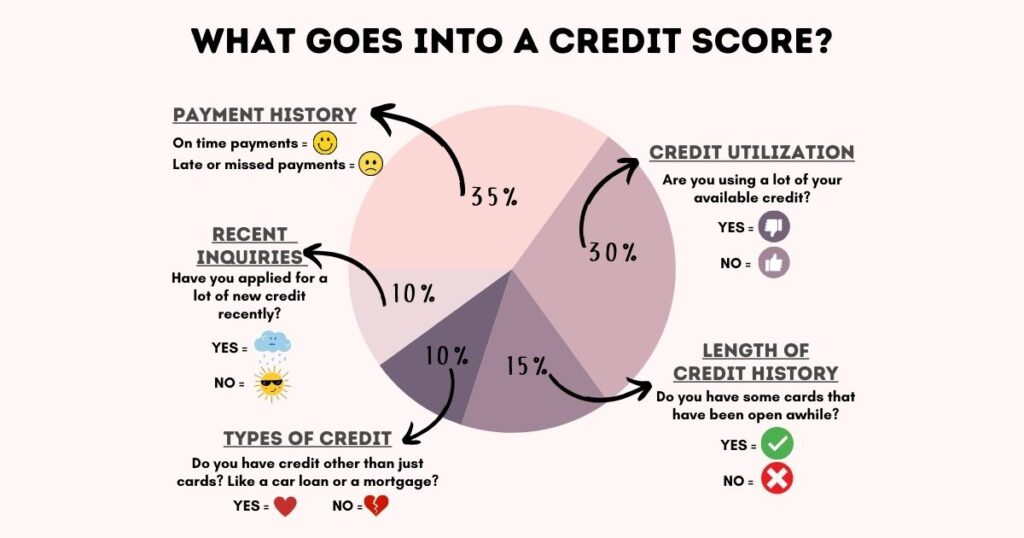

Here is what goes into a credit score:

- Payment history: This is the most important factor in determining your credit score. It makes up about 35% of your total score. Late or missed payments will significantly lower your credit score. And the kicker is, these late or missed payments stay on your credit report for SEVEN YEARS (!!!).

- Credit utilization: Refers to the amount of credit you use compared to your credit limit. Your credit utilization makes up 30% of your credit score. Another reason it’s essential to pay your balance in full every month!

- Length of credit history: Having credit cards open for many years can positively impact your score. Banks love it when you establish a long history of responsible credit use with them. This is important to consider when weighing whether or not to cancel a credit card when the annual fee comes due.

- Recent credit inquiries: A lender will run your credit report when you apply for new credit. This inquiry can slightly lower your credit score. This ding is usually minimal (a few points) and can be regained by ensuring you pay off all your balances every month.

- A mix of credit: A diverse mix of credit, such as credit cards, auto loans, and mortgages, can indicate a responsible credit user and increase your credit score.

How can I check my credit score?

There are a few ways to check your credit score:

- Get a free credit report. Every year, you are entitled to a free credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion. You can request your free report by visiting annualcreditreport.com.

- Sign up for a credit monitoring service. Many companies offer credit monitoring services that provide access to your credit score and report. Some popular options include Credit Karma, Credit Sesame, and Experian.

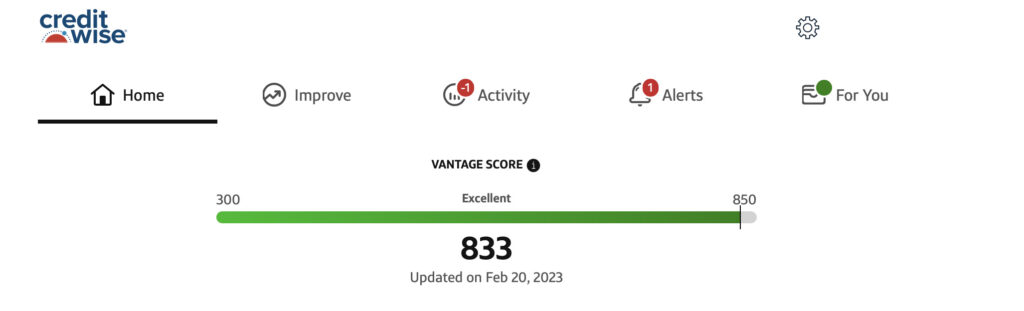

- Check with your bank or credit card issuer. Many banks and credit card issuers offer free credit scores as a benefit to their customers. For example, my Capital One Venture X card provides me with a free creditwise score dashboard that I can see every time I open my Capital One app.

A note about women and credit

I have discovered that it is common for women to inadvertently tie themselves to their spouse’s credit. When a new vehicle is purchased or a lease is signed, the husband uses his name for the loan or lease.

This may seem harmless enough, but it will damage a woman’s credit in the long run. I have many friends in their 40s who have horrible credit. Not because they have defaulted on any loans, but because they have never had any credit cards or loans in their name.

Financial literacy is an essential tool for women. Being fiscally savvy is wholly intertwined with the hobby of credit card points and miles. I love that my kids see me as being in control of money, organized, and thoughtful in my financial decisions.

The added bonus is the insane number of fantastic trips we take with the benefit of credit card points and miles. Don’t despair if your credit score is lower than desired. Use it as a nudge to get you in control of your finances and on your way to free travel!

Conclusion

A healthy credit score is your first step toward being a financially savvy woman with access to excellent credit card offers. Before you start your reward travel journey, check your credit score. If it’s less than desirable, no problem! Understanding how a credit score works is half the battle.

Working to improve your credit score is an excellent step toward financial literacy. There’s no better feeling than becoming money-smart while at the same time using credit card points to take your family on a trip to a place you never thought you’d visit!