We know that a healthy credit score is your first step toward being a financially literate woman with access to excellent credit card offers. Before starting your reward travel journey, one of the first steps is to check your credit score. You will want a score in the 700s to snag the cards with the best offers. Are you under 700? Don’t worry! Working towards increasing it will be great practice on your path toward financial literacy.

It will take a little time, but once you have strengthened your score, you will be ready for your reward travel adventures. You can find a more detailed description of what goes into a credit score here. In the meantime, let’s review ways to improve your score.

Ways to Improve your Credit Score

1) First, focus on becoming credit card debt free

You shouldn’t start travel hacking until you are 100% credit card debt-free. So, if you are carrying a balance on any of your cards, you’ll first want to focus all of your energy on paying these off. Paying off your cards increases your credit score and sets you up for success in travel hacking!

2) Once you are credit card debt free

YAY! Keep up the excellent work!! Make sure you are reaping max credit score points for your hard work. Here’s how you can further improve your credit score by fine-tuning your credit utilization:

- 30% of your credit score is determined by whether you have card balances (aka credit utilization).

- Credit card companies randomly report your utilization to the credit bureaus during the month.

- This won’t necessarily line up with when your balance is due.

- Let’s say you have a card with a $5000 credit limit. This month you have made $3000 worth of charges on this card.

- You plan on paying all $3000 off when the statement comes due on the 31st.

- It’s possible, however, that the credit card company gives its monthly report to the credit card bureaus on the 25th of the month.

- In this case, it will look like you are utilizing 60% of your available credit, which will lower your score. EVEN THOUGH you plan on paying the card off that month.

It seems crazy, I know. But, being strategic in your bill paying is a quick and easy way to increase your score rapidly. I do this by paying off my credit card multiple times per month. You will quickly see your score increasing if you get in the habit of doing this.

3) Comb through your credit report

Double-check your credit report for any errors that can negatively impact your score. An error isn’t likely, but it’s also not unheard of. Examples of some mistakes are fraudulent or duplicate accounts or misreported payments. Any mistake on your report can drag down your score, and you’ll want to address it ASAP.

4) Make sure you have a variety of different credit and loans

Mix up your credit! Make sure your name is on the household bills: mortgage, utilities, you name it. Paying these bills on time every month will improve your credit mix score, which makes up 10% of your overall score.

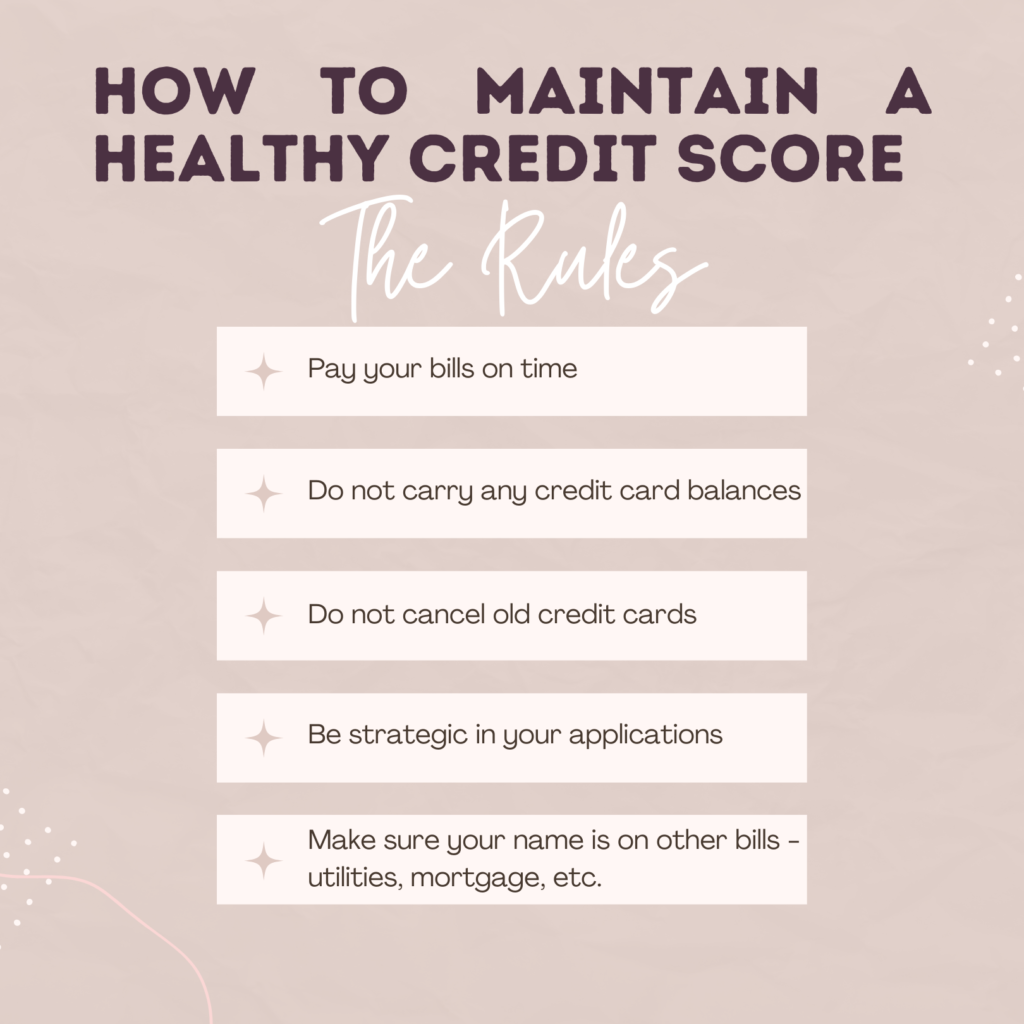

5) Continue to maintain

Once you have worked on increasing your overall score, you want to make sure you maintain it:

Conclusion

It’s possible your credit score could use a little TLC before you are ready to start opening cards for reward travel. Think of it as a crash course in controlling your finances and increasing your money savviness! Follow my tips to improve your score, and once you see that hard work pays off, don’t forget to maintain it constantly. Once you are ready to start applying for cards, be sure you are strategic in your applications. Read about my favorite beginner strategy here.