Jumping out into the world of reward travel can be exciting and overwhelming, especially when faced with the endless options for credit cards. I always suggest starting with a card that earns transferable points, as they are the most flexible. Having a starter card with a low annual fee is also nice. This is why I always suggest the Chase Sapphire Preferred as the absolute best starter card for reward travel.

Specifics of the Chase Sapphire Preferred

Ultimate Rewards

The points you earn on the Sapphire Preferred card are called Chase Ultimate Rewards. Ultimate Rewards are SUPER flexible. They are transferable points that you can move from Chase into hotel and airline partners. Chase has its own travel portal where you can book travel using your Ultimate Rewards. However, as I went over in this article, it’s almost always a better value to skip the portal and transfer your Ultimate Rewards to a hotel or airline program.

Annual Fee

The Chase Sapphire Preferred has an annual fee of $95. In general, I find this fee totally worth it for a handful of reasons. Mostly, I love that the Chase Sapphire Preferred gives me the ability to transfer the Ultimate Rewards that I have also earned on my other Chase cards (aka the Chase Trifecta).

Card Perks

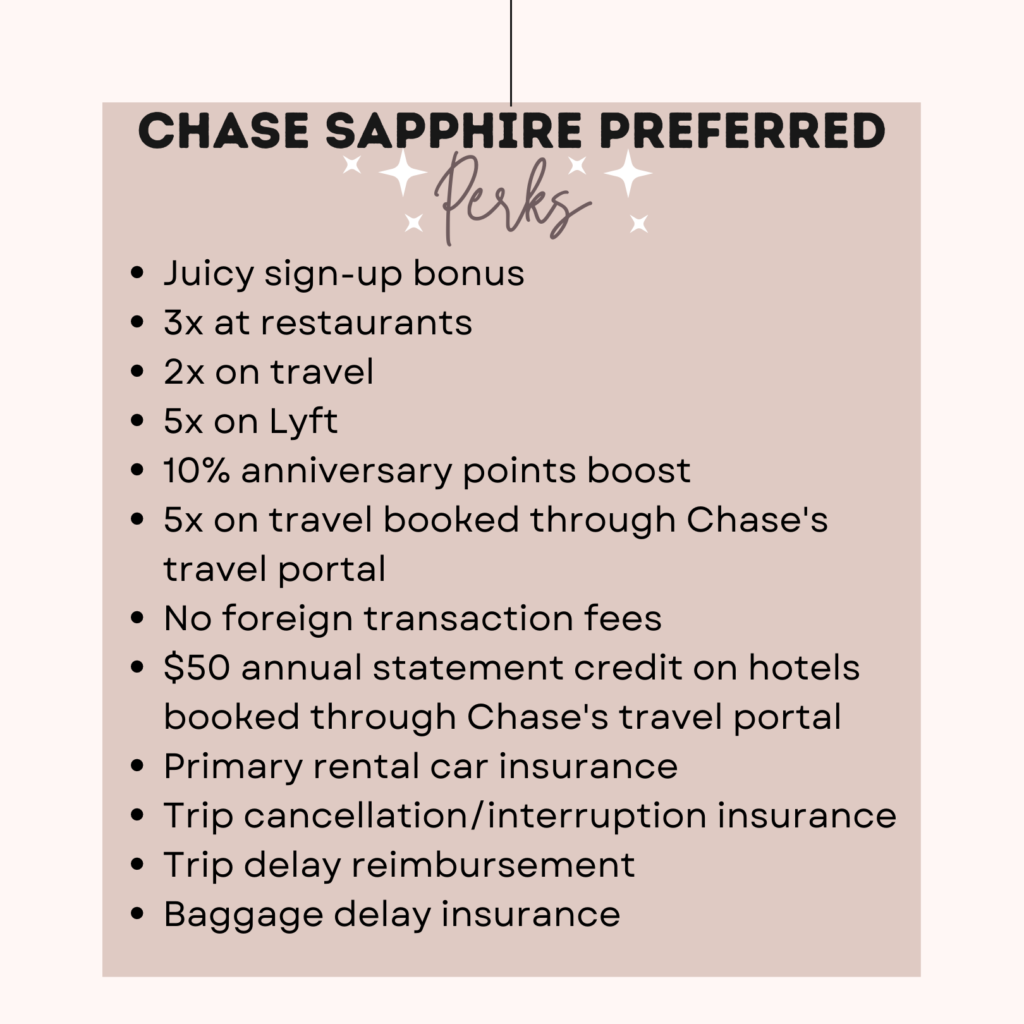

The Sapphire Preferred is flush with perks – especially for those of us who love to travel. It’s always best to read the nitty gritty details but here are the basics:

Points Perks

- Sign-up bonus: Typically, this is around 60,000 Ultimate Rewards but has reached as high as 100k – not too shabby!!

- Bonus points for certain categories – Earn 5x on Lyft, 3x at restaurants, 2x on travel, and 1x everywhere else.

- 10% anniversary gift – Every year on your account anniversary, you’ll earn Ultimate Rewards equal to 10% of your total purchases for the year. For example, If you spent $10,000 on your CSP in a year, on your account anniversary you’ll receive 1000 bonus points.

Travel Perks

- Travel Portal – Generally, it is better to transfer your Ultimate Rewards to a airline or hotel portal. However, if you find yourself snagging a deal on the Chase travel portal, you’ll earn 5x on these bookings.

- No foreign transaction fees – A great card option to use outside the United States as you won’t pay foreign fees on any of your transactions.

- $50 hotel credit – Receive an annual $50 statement credit for a hotel stay booked through the Chase travel portal.

- Primary rental car insurance – Decline that expensive insurance offered at the rental car desk! Pay with your Chase Sapphire Preferred and you’ll have primary coverage. This provides reimbursement up to the actual cash value of the rental car for theft and collision damage for most rental cars in the U.S. and abroad.

- Trip cancellation insurance – This covers pre-paid, non-refundable travel expenses if your trip is canceled or cut short because of illness or severe weather.

- Trip delay reimbursement – Up to $500 per ticket to cover meals and hotel if your trip is delayed more than 12 hours.

- Baggage delay insurance – Get reimbursed for essential purchases (think clothes, toiletries, etc.) if your bag is delayed over 6 hours.

In conclusion

It can be overwhelming to decide which card to apply for first. My personal recommendation is to go with the CSP. It has a ton of perks and a manageable annual fee. This makes the Chase Sapphire Preferred one of the best reward credit cards for travel and an excellent starter card!