Credit cards that offer transferable points are the most valuable for booking reward travel. This is because the ability to transfer points to airline and hotel partners is what allows you to unlock mega value. One of the most valuable transferable points programs is Chase Ultimate Rewards. In this article, we’ll explore how to maximize your earning potential with the Chase Trifecta.

What are Ultimate Rewards?

Credit card points and miles are like a currency. The currency of Chase cards is called Ultimate Rewards. Ultimate Rewards are SUPER flexible. You can move these transferable points from your Chase account to your hotel and airline accounts.

Chase also has its own travel portal to book travel using your Ultimate Rewards. However, as I went over in this article, it’s almost always a better value to skip the portal and transfer your Ultimate Rewards to a hotel or airline program.

What is the Chase Trifecta?

The Chase Trifecta is a trio of Chase credit cards that can help you rack up major rewards across all sorts of spending categories. Basically, it’s a sweet spot strategy to earn tons of Ultimate Rewards.

The Chase Trifecta: Step #1

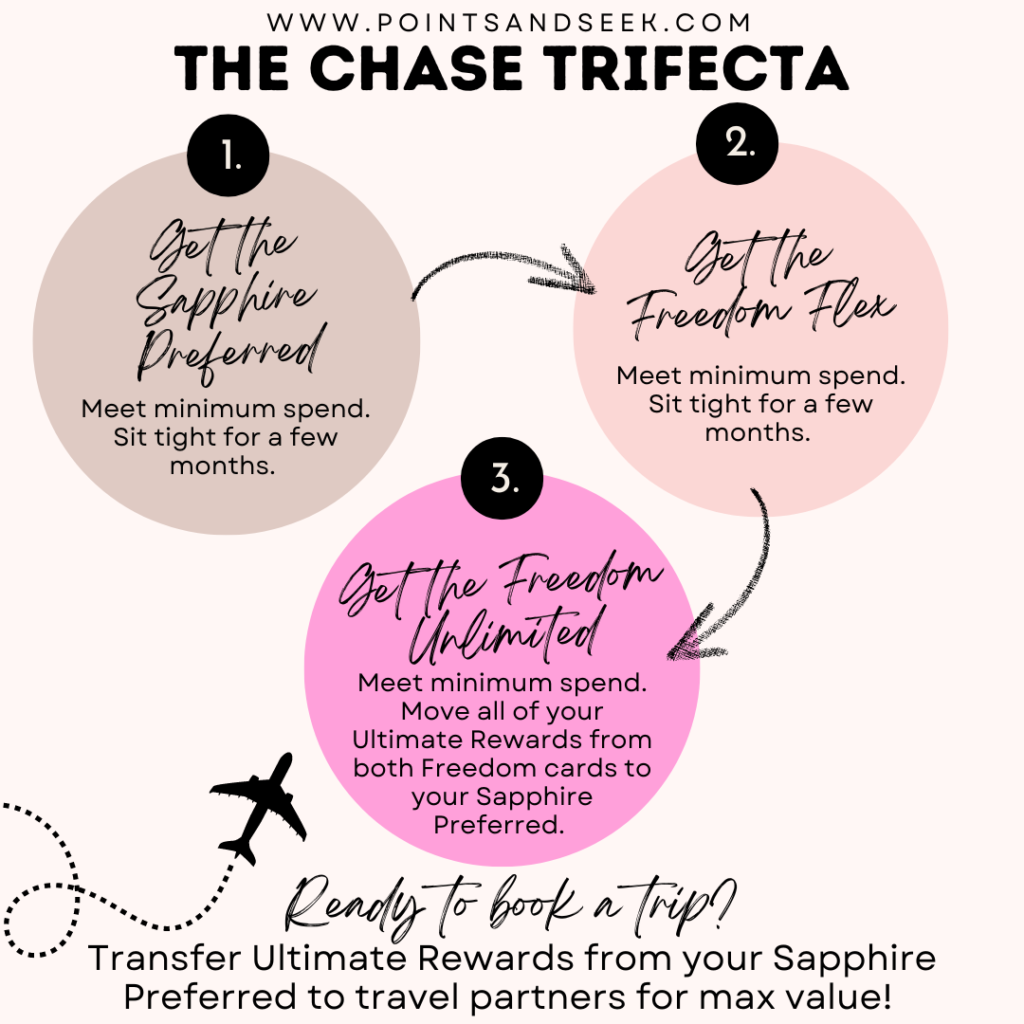

As you already know, my absolute favorite beginner’s card is the Chase Sapphire Preferred. It has a great sign-up bonus, a relatively low annual fee, and tons of travel perks.

The Ultimate Rewards you earn from the sign-up bonus and ordinary daily spending are most valuable when transferred out of Chase and into a hotel or airline program. So, the first step is getting your hands on this card, and I always suggest applying for this card first when you begin your travel hacking journey.

The Chase Trifecta: Step #2

Once approved for the Chase Sapphire Preferred, you will want to sit tight for a bit. Make sure you hit that minimum spend and give it at least three months before you apply for your next card. And that next card will be (drumroll please) the Chase Freedom Flex.

I know that this is marketed as a cash-back card and that the whole point of reward travel is to acquire points and miles (not earn cash back towards statement credits). But here’s the deal: Chase advertises this as a cash-back card, but it technically earns Ultimate Rewards.

Now, you can convert those Ultimate Rewards into cash if you want. But we don’t want that because there is so much more value to be gleaned from transferring to partners. You can only transfer Ultimate Rewards to travel partners if you have the Chase Sapphire Preferred, the Chase Sapphire Reserve, or the Chase Business Ink Preferred. But you’re golden because you already got the Sapphire Preferred as step 1 of 3 in achieving the trifecta.

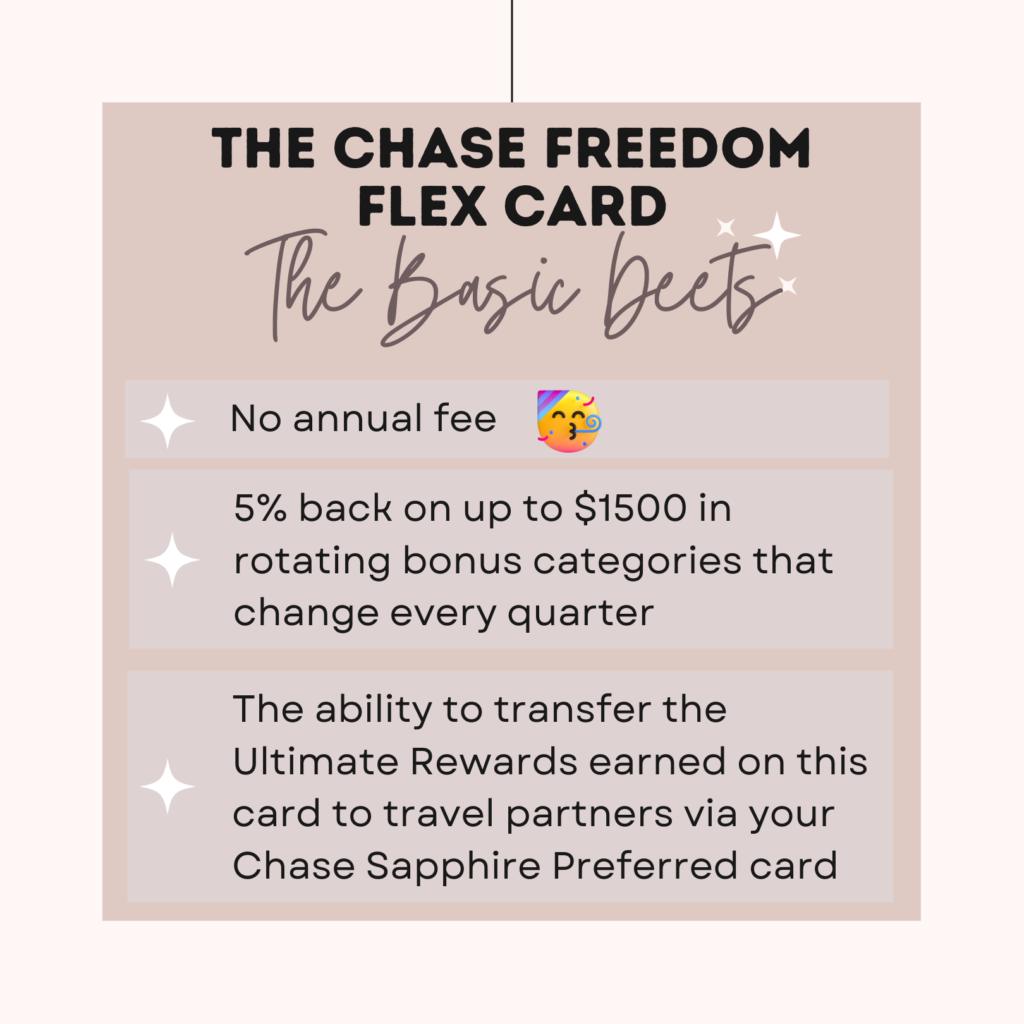

Here are the basic details of the Freedom Flex:

- No annual fee: Yay!

- 5% back on up to $1500 in purchases in bonus categories that change every quarter. These categories typically include popular spending areas such as gas stations, grocery stores, restaurants, and Amazon. Chase announces the upcoming quarterly categories in advance so you can plan your spending accordingly.

- If you max out the $1500 bonus category, that equals 7500 Ultimate Rewards per quarter.

The Chase Trifecta: Step #3

Now that you have the Chase Sapphire Preferred and the Freedom Flex, you will want to lay low again. Ensure you’ve hit the minimum spend and put some organic spend on both cards. Once a few months have passed, the final step is to apply for the Chase Freedom Unlimited. This card is also a “cash-back card,” like the Freedom Flex card is cash-back. Your sign-up bonus and points earned from regular spending will come to you as Ultimate Rewards.

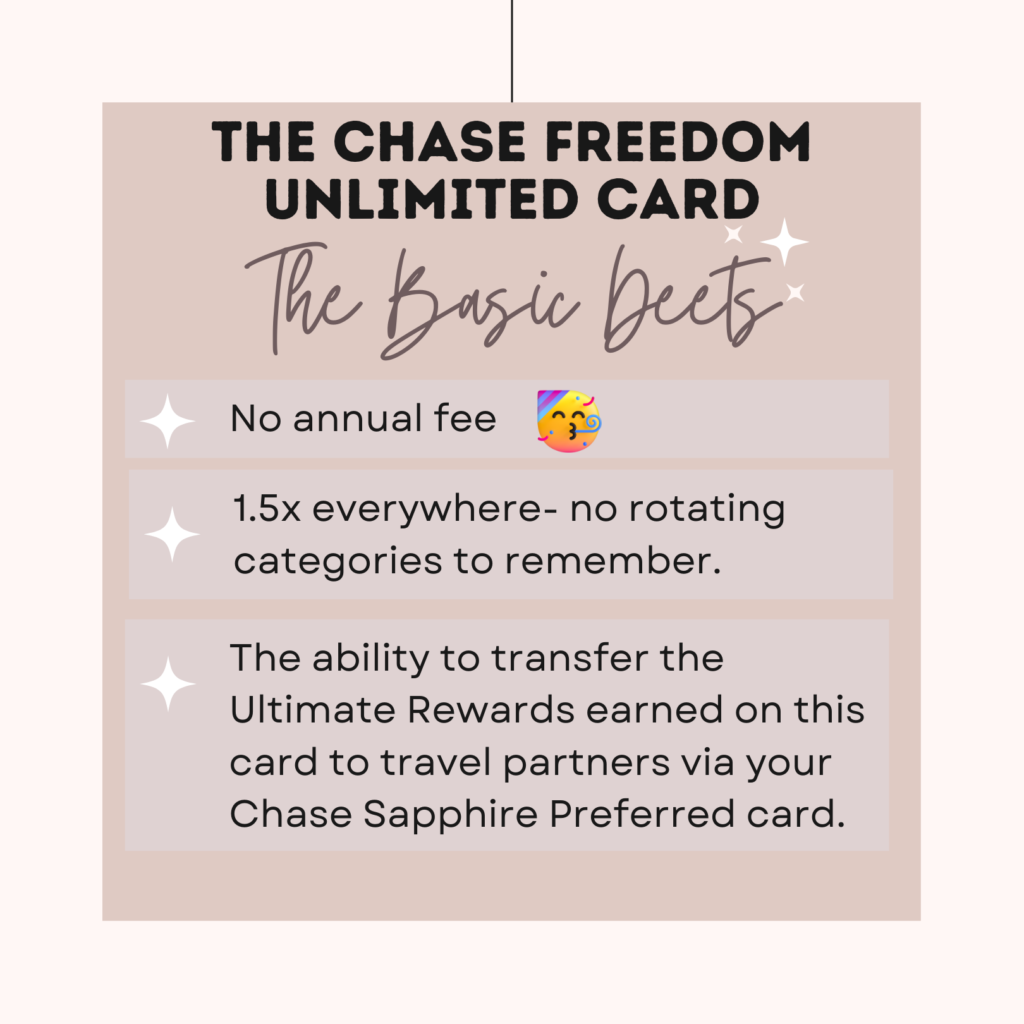

Basic Details of the Freedom Unlimited:

- No annual fee: Yay!

- 1.5x everywhere: easy peasy- no rotating categories to remember or worry about.

To break down the trifecta:

Once you have achieved the illustrious trifecta, you’ll want to combine your Ultimate Rewards onto your Chase Sapphire Preferred card. From there, you can transfer those Ultimate Rewards to travel partners. Remember, don’t transfer to partners until you are ready to book travel and are positive that there is award availability for your dates.

Conclusion

Having the right Chase cards in your wallet is a must for travel hackers, and it requires some planning and patience to achieve the Chase Trifecta. However, once you have it in your wallet, it is a great way to earn tons of Ultimate Rewards.