The first big money move on your journey to financial literacy is to create an emergency fund. This fund should hold three to six months’ worth of living expenses. Depending on your line of work, this amount has some wiggle room. If your job comes with immense stability (a tenured school teacher, for example), then three months is sufficient. Six months’ worth of funds is better if your job market is more volatile. The money in your emergency fund should sit and only be touched, well, in case of an emergency.

Why should you have an emergency fund?

More than anything, an emergency fund gives you peace of mind. This means that if your car suddenly kicks it, you can tap into your emergency fund rather than having to put the repair charges on a high-interest credit card that forces you into debt. An emergency fund means that if you and your partner split, you have the funds to quickly be able to put the first and last month’s rent down on a new apartment. This security is priceless.

Where should you park your money?

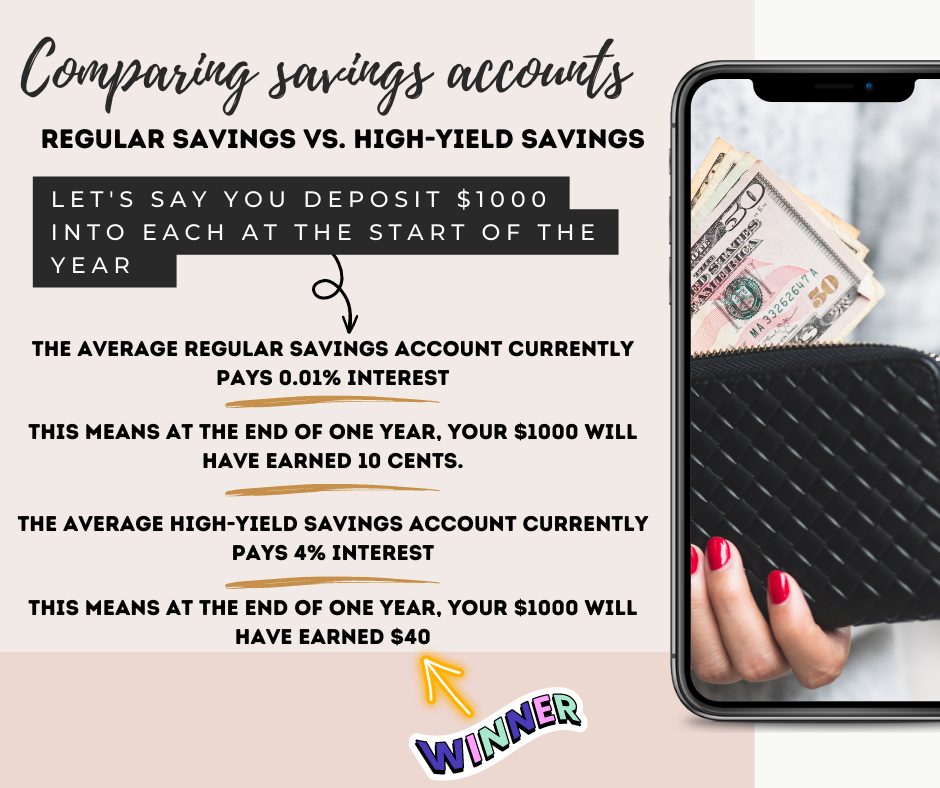

Your emergency fund should always be in a high-yield savings account (HYSA). High-yield savings accounts offer significantly higher interest rates compared to standard savings accounts. This means that your money can grow faster over time (yay, compounding interest!), allowing you to grow your savings and keep up with inflation. I personally use American Express for my HYSA, but a quick Google search will give you a list of the best high-yield savings accounts and the current rate that they are paying.

What makes a HYSA better than a regular savings account?

How do you save?

Your first step in achieving financial literacy should be to create this emergency fund. This means you need to build into your budget a weekly or monthly deposit into this account. Focus all your effort and extra money on saving at least three months’ expenses. This may take a while. That is OK! Do the best you can. In the beginning, while you are building this fund, you’ll need to have some come-to-Jesus talks with yourself about spending. Be sure you are only spending on things that bring you sustainable joy. You don’t need to deprive yourself, but also be sure you aren’t wasting money on frivolous junk.

What happens after you fund your HYSA?

After you have your three months’ worth of expenses saved in your HYSA, it’s time to switch gears and zero in on eliminating your debt.

TL;DR

Every woman needs the safety net of an emergency fund. Park these funds in a high-yield savings account, and ensure you contribute regularly. Remember, this account is for emergencies only (no dipping in for travel or a new car). Once you have this account built up, let it be, and it will make money for you while you sleep.