Starting your reward travel journey can be confusing, especially when it comes to applying for your first credit card. The good news is I have a favorite beginner’s card and a step-by-step strategy for getting started. So, let’s get into it!

A Step-by-Step Guide to Applying for your First Card

1) Check your credit score

First things first, you’ll want to check your credit score and credit report. Before applying for new credit cards, you’ll want a credit score of at least 700 and zero credit card debt. Don’t stress if you’re not there yet. Take this as an opportunity to pay off debt and build your financial literacy.

2) Let’s talk about Chase

I focus my strategy on acquiring Chase cards first. Why? A couple of reasons. One, their Ultimate Rewards are super valuable, and they have a ton of great transfer partners. Two, they are finicky in their approvals as they have an unwritten rule called the 5/24 rule.

3) Understanding 5/24

The basic gist of 5/24 is that Chase will not approve you for a new card if you have opened more than 5 new credit cards in the last 24 months. The five-card limit isn’t just for Chase cards – it applies to all cards. Let’s say you’ve opened six new American Express cards in the past two years. That means you’re over the 5/24 limit, and if you try to apply for a new Chase card, you’ll be met with a big fat NOPE.

4) Travel partners vs. travel portals

Chase offers a travel portal where you can redeem your Ultimate Reward points for travel. However, the real value of credit card points and miles is when you transfer them to airline and hotel partners. Here I break down why it’s almost always better to book through a travel partner rather than on a travel portal. Keep in mind, though, that not all Chase cards can transfer Ultimate Rewards to travel partners. In fact, only a couple of personal cards offer this perk. The first is a luxury card, the Chase Sapphire Reserve. The second is my favorite beginner’s card, The Chase Sapphire Preferred.

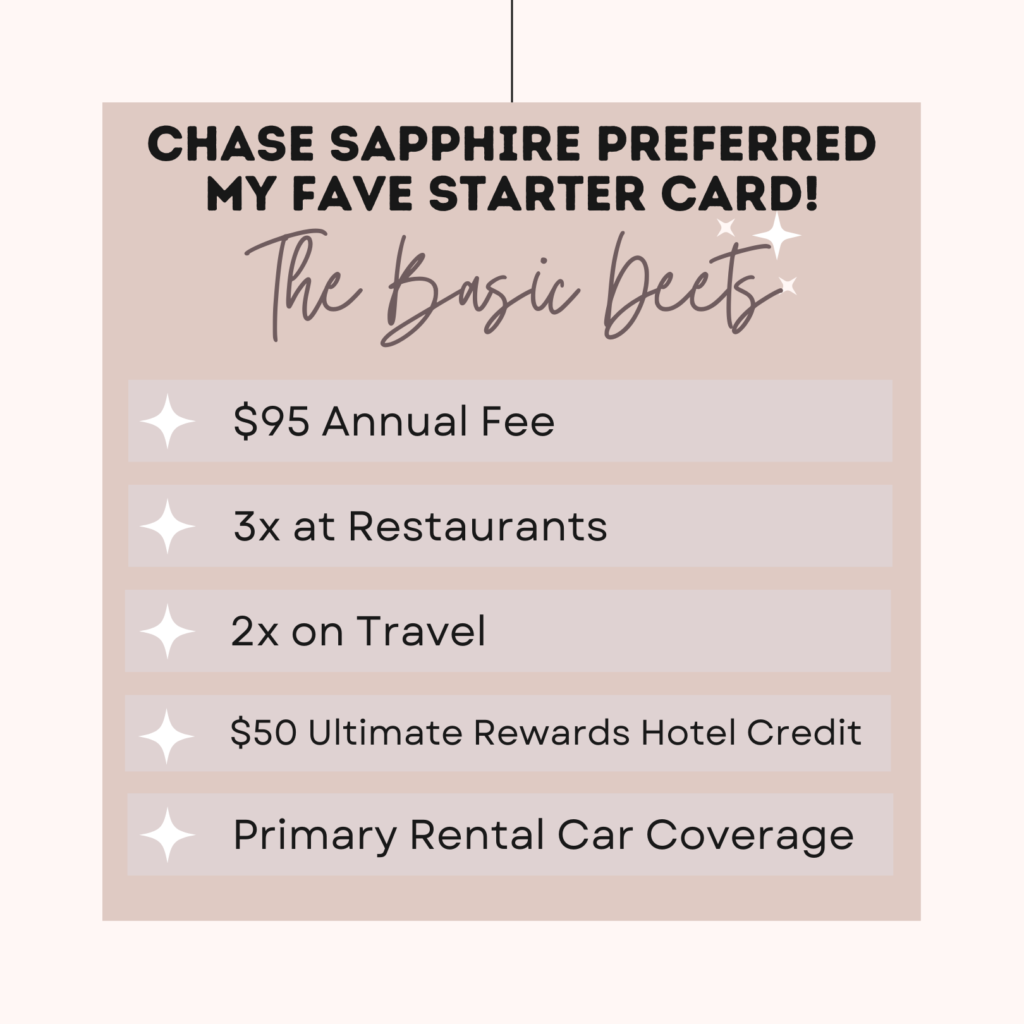

5) Details of the Sapphire Preferred card

For a deeper dive, check out this article on my favorite beginner’s card – the Chase Sapphire Preferred. Here are the basics:

6) Let’s apply!

I’m SO grateful to those that use my referral link to apply for cards. It costs you nothing and makes it so I am able to continue creating miles and money content! ♥

☞☞☞ APPLY HERE

The Chase Trifecta

Once approved for the Chase Sapphire Preferred, your first step is to hit that minimum spend! Once you’ve hit that minimum spend and banked that sign-up bonus, you’ll want to work on building what is known as the Chase Trifecta. There are a few ways to achieve the Chase Trifecta, but here is how we will do it for my beginner’s guide.

Our trifecta is comprised of three Chase cards: The Chase Sapphire Preferred, The Chase Freedom Flex, and the Chase Freedom Unlimited. The Flex and the Unlimited are technically cash-back cards (cringe). However, if you have these cards with the Chase Sapphire Preferred, you can convert those cash-back points into Ultimate Rewards. Then, you’ll use these Ultimate Rewards to transfer to hotel and airline partners.

AN IMPORTANT NOTE: Don’t go crazy and apply for all three cards at once. You’ll want to start with the Chase Sapphire Preferred. Then wait 3-6 months before applying for the Chase Freedom Flex, and then wait another 3-6 months before applying for the Chase Freedom Unlimited. If you try to apply all at once, you will most likely get denied. So, slow your roll! One card at a time.

In Conclusion..

As you begin your reward travel journey, remember that the right credit card can make all the difference in unlocking incredible travel opportunities. By starting with the card I’ve recommended and following the step-by-step strategy I’ve outlined, you’ll be well on your way to earning points and miles that can take you to your dream destinations. Stay patient, stay informed, and most importantly, enjoy the process—because the rewards are well worth it. Happy travels!