The main idea behind award travel is that you sign up for a new card, meet the minimum spend within the given time frame, earn the sign-up bonus, and use those miles to book a trip! Then, you rinse and repeat the entire process! Naturally, this begs the question – isn’t having too many credit cards horrible for your credit? The short answer is – no! It’s a common myth that travel hacking will tank your credit score. When in reality, this isn’t true.

I have around 24 open credit cards, and my score is 833! My goal is to empower women to take control of their finances and explore the world through smart strategies. So, understanding this aspect is a crucial component of travel hacking. Let’s dive in!

What is a credit score?

Your credit score is a number used to represent your creditworthiness. Creditworthiness is a fancy way of saying how likely you are to pay your debt back on time. Banks, credit card companies, and mortgage companies use this credit score.

The most widely used credit score model in the United States is the FICO score, which ranges from 300 to 850. The higher your score, the better, as it indicates to banks that you are at a lower risk of defaulting on a loan or credit card payment.

How is your credit score calculated?

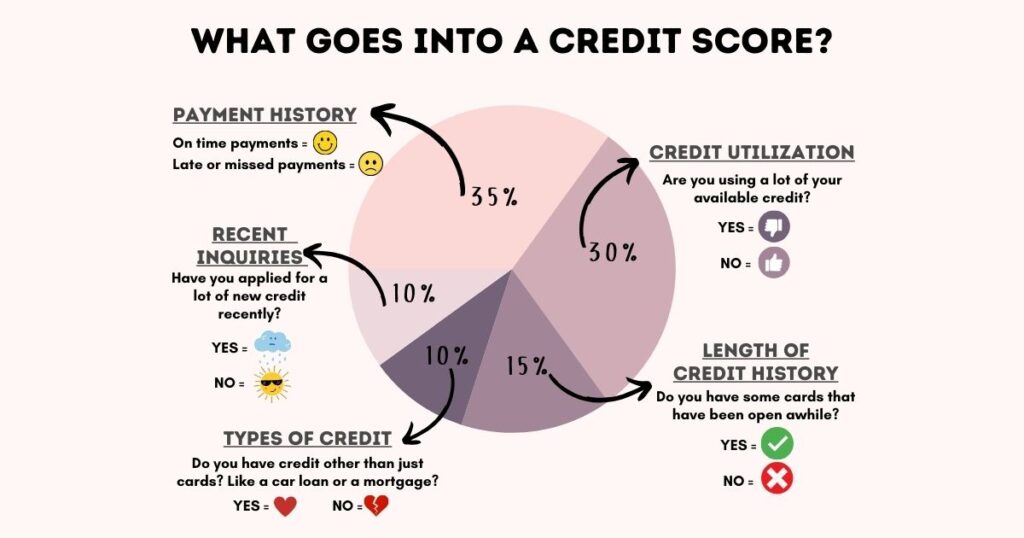

- Payment history: This is the most critical factor in determining your credit score. It makes up about 35% of your total score. Late or missed payments will significantly lower your credit score.

- Credit utilization: Refers to the amount of credit you use compared to your credit limit. Your credit utilization makes up 30% of your credit score.

- Length of credit history: Having credit cards open for many years can positively impact your score. Banks love it when you establish a long history of responsible credit use with them. This is important when weighing whether or not to cancel a credit card when the annual fee comes due.

- Recent credit inquiries: A lender will run your credit report when you apply for new credit. This inquiry can slightly lower your credit score. This ding is usually minimal (a few points).

- A mix of credit: A diverse mix of credit, such as credit cards, auto loans, and mortgages, can indicate a responsible credit user and increase your credit score.

My strategy

These are the things I will always do to ensure I can open a handful of new cards each year and still maintain a stellar credit score.

- Avoid carrying balances on any cards. I never carry a balance on any of my cards. This is the number one rule of travel hacking success. If you aren’t yet at the place where this is possible, you need to pump the brakes on reward travel and focus on strengthening your finances.

- Pay off card balances regularly. I pay off each of my cards once per week. You can set them on auto-pay or set aside an hour each week to go through your cards and pay the balance in full. This is the quickest and easiest way to see a massive increase in your score.

- Retain longstanding cards. I never close cards that I have had for a long time. I call these “sock drawer cards.” They are in a bag in my sock drawer, and I never use them. I have had them forever, and canceling them would affect my credit score! Instead, I pull them out once per year to buy a cup of coffee and then put them right back into the sock drawer.

- Space out new credit card applications. I space my new applications out by a few months to minimize score dips. Every new inquiry will hit your credit score by a couple of points. You can recoup these points by paying off your card multiple times per month. However, it’s best to space out your applications so you have a month to regain those points before submitting your next application.

TL;DR

Don’t let the fear of lowering your credit score hold you back from travel hacking! It is a misconception that too many cards will hurt your score. By establishing a solid financial foundation and implementing prudent credit management practices, you can maintain a healthy credit score and potentially watch it increase over time!