Once you have created your emergency fund, your next big money move will be paying off your debt. Chances are, you have some debt—some may be considered good debt, like a mortgage, while some may be bad debt, such as credit card balances. But in the end, debt sucks. So, let’s focus on eliminating it.

Write it down

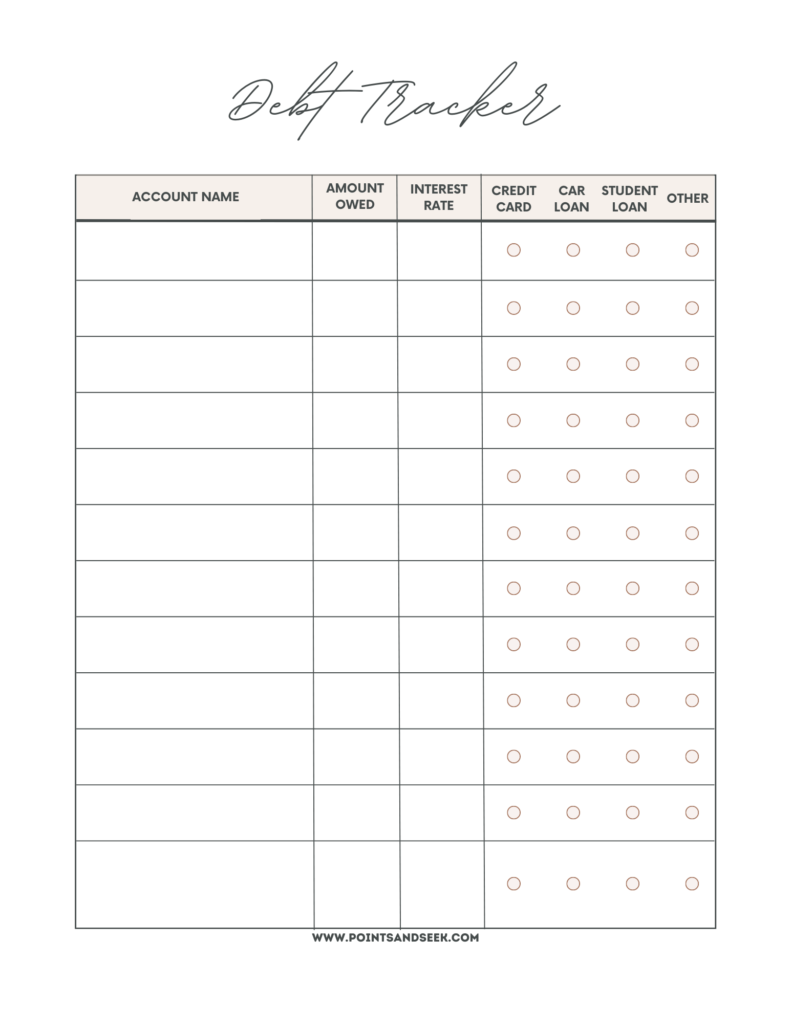

First things first: write it all down. I mean everything, like seriously EVERYTHING. Student loans, car payments, Target credit cards, regular credit cards—if you owe money on it, put it on your list. It’s time to spend a few hours figuring out who you owe, how much you owe, and how much it’s costing you. Yeah, it won’t be fun, I know. But it’s super important to see the big picture and make a game plan to start paying it off. A simple list like this will do the trick:

Rank it

Once you’ve got your list, divide it into high-interest and low-interest debts. High interest means anything with an interest rate of 7% or more. Low interest is anything below 7%.

Laser focus on high-interest debt

Don’t sweat your low-interest-rate debts; keep making the minimum payments. The real goal is to tackle those high-interest debts first. Pick the one with the highest interest rate and throw EVERY.EXTRA.DIME you have at it. The money you allocated towards your emergency fund will now be directed towards paying off this debt.

Work your way down the list

Your primary financial priority is to work your way down the list of high-interest debts, knocking them out one by one. It might be a slow process, but it’s worth it. You can do it, believe me! It’s crucial to find a strategy that works for you. Before splurging on big purchases, give it some serious thought. Will it serve you? Make you happy? Is it something you’ll use for a long time? If not, forget about it and put that money towards your debt. There is no need to eat ramen noodles every day, but be smart about your spending. Find that sweet spot that allows you to pay off your debt without feeling like you’re sacrificing everything.

Conclusion

Having high-interest debt is a pain, but don’t worry, you’ve got this. Write down all your debts, focusing on the high-interest ones (7% or higher). Start by attacking the debt with the highest interest rate, throwing every spare penny at it. As you work down the list, you’ll gain momentum and inch closer to financial freedom. Remember, keep your eyes on the prize, and don’t let debt bring you down!