If you’re working a traditional 9-to-5 but have a side hustle, you could be tapping into a goldmine of extra credit card sign-up bonuses! Many people assume that business credit cards are only for big companies or full-time entrepreneurs, but that’s far from the truth.

Even if your side gig is small—whether you’re freelancing, selling crafts online, or driving for a rideshare app—you probably qualify for a business credit card. And the best part? These cards often have incredible signup bonuses that can supercharge your points balance and help you book that trip even faster.

What qualifies as a business?

There are so many side hustles that can qualify as a business. Here are a few possible options:

- Dog walking

- Re-selling on eBay or Facebook Marketplace

- Renting out a room on Airbnb

- Owning a shop on Etsy

- Babysitting

- Owning a rental property

- Driving for Lyft or Uber

- Freelance writing or photography

- Delivering for DoorDash or Instacart

- Freelancing on Fiverr

- Selling printables on Creative Market

- Selling on Amazon

- Blogging

- Tutoring

- Renting out your car on Turo

The list of possible side hustles is endless! And this side gig doesn’t need to be your main source of income to qualify for a business credit card.

Applying for business credit cards

You can apply for an EIN to make your small business more official. This is a Federal Tax ID given by the IRS. The application is quick, and you get your number instantly. If you have an EIN, you will use it when applying for a business credit card.

Having an EIN isn’t mandatory, though. Suppose your side hustle is small and generates little income. In that case, you can also apply for a business card using your Social Security Number (this option is available for sole proprietorships).

One key when applying is to be honest! Don’t inflate your estimated income to make your application seem more desirable. If you think your business will only make $300 this year, be honest with the banks about this number. I applied for and was approved for many business cards when my business was just getting off the ground and had zero income to its name! You gotta start somewhere, and banks understand this.

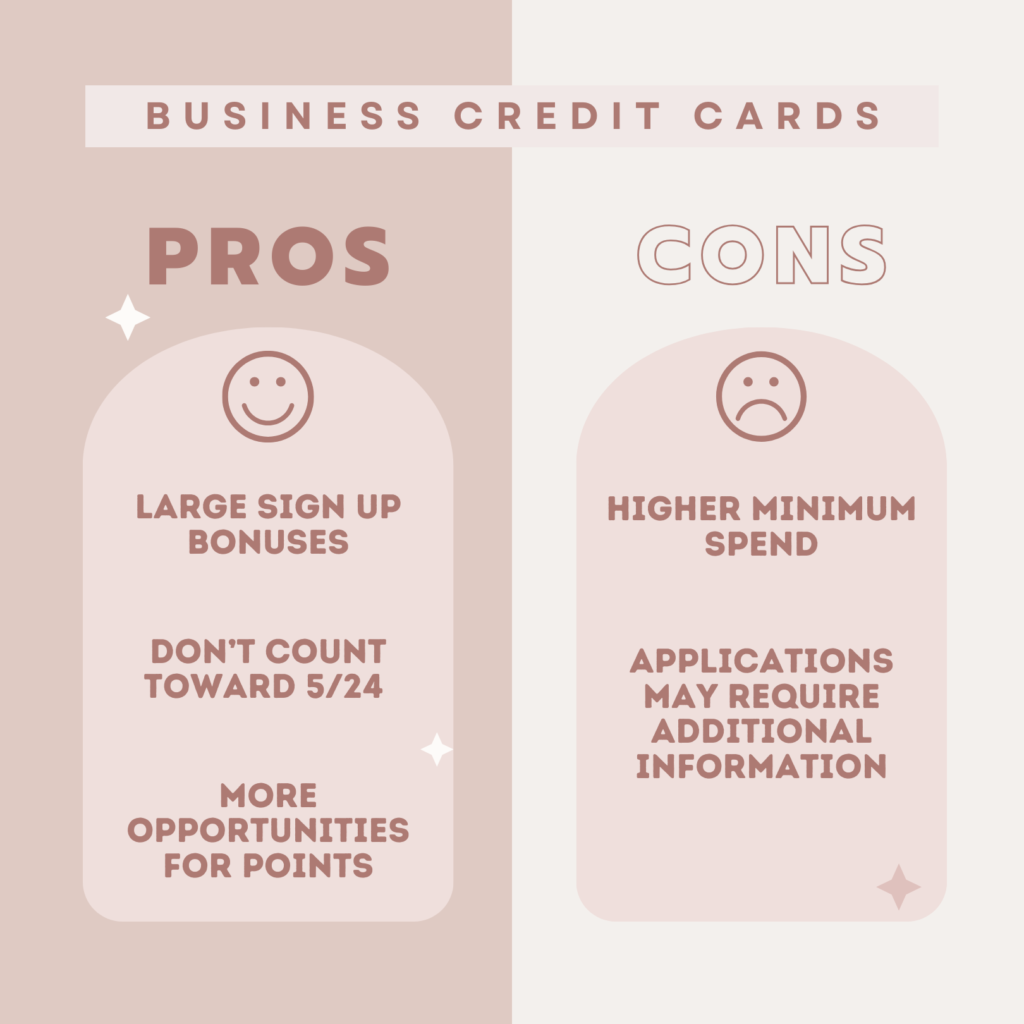

The pros and cons of business credit cards

Pros

- Business cards generally have higher sign-up bonuses than personal cards. One of my favorite business cards, The Chase Ink Business Cash card, has a super generous sign-up bonus – not too shabby for a card with zero annual fee!

- Unlike personal cards, most business cards don’t count toward 5/24.

- Being eligible to apply for business credit cards greatly expands your opportunities for earning points and miles.

Cons

- While business cards generally come with higher sign-up bonuses, they also have higher minimum spend requirements. One of my absolute best card pickups was the Capital One Venture X Business card – it offers a 150,000 point sign-up bonus (😱) for $30,000 spend in three months (😱😱). Normally, I would never be able to come close to meeting this type of minimum spend. However, this happened to time perfectly with a home renovation we were doing. So, I paid our contractor using the Capital One card and then paid the card off with our construction loan. Long story short – that type of sign-up bonus is unheard of on a personal card.

- Business card applications sometimes require more work. Most of my business applications go through right away. However, occasionally, banks will ask for some additional information. This can be easy, like a SSN check or an address verification. Sometimes, they will call and want to discuss your spending plans, ask for more details about your business, etc. I always answer these questions truthfully and have never had problems eventually getting approved.

In Conclusion

Business cards are powerful tools in the game of reward travel. Don’t be afraid to apply! It’s likely you are already running some type of side hustle that absolutely qualifies as a business. Having access to business credit cards opens up a whole new world of points and miles!