Once you have put three months of expenses in your emergency fund and paid off your high-interest debt, it’s time to focus on your retirement. While investing in retirement may not seem particularly cool or thrilling, starting early is key. You might be wondering why you need to start investing now for something that seems so far away. The simple answer is – delaying retirement savings means prolonging your working years. If that’s not a motivating kick in the butt, I don’t know what is. So, here’s the lowdown on common retirement accounts. Time to start saving!

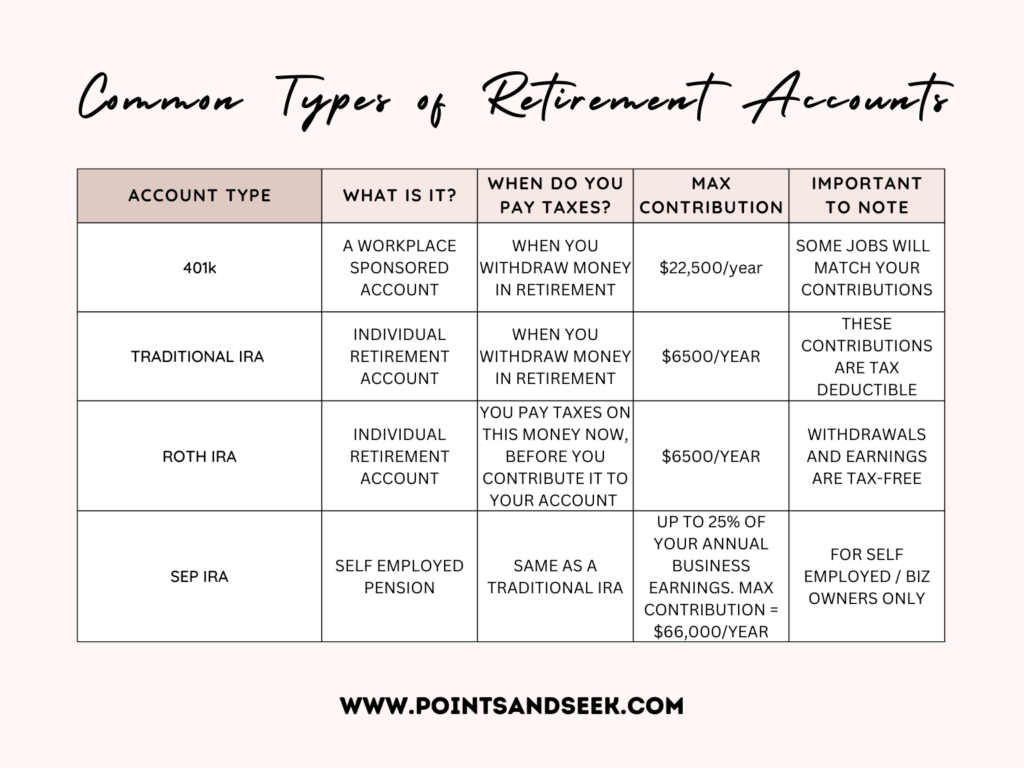

Common types of retirement accounts

401k

What is it? This is a workplace-sponsored retirement account typically offered by private-sector employers.

What’s the tax situation? Contributions are made pre-tax, which means you don’t pay taxes on the money now, but you do pay taxes when withdrawals are made during retirement.

Max contribution: $22,500 per year

Important to note: Some employers will offer to match your contributions. If this is the case for you, jump all over this! It is free money; you should contribute as much as you possibly can.

IRA

What is it? This is a personal retirement account you can open on your own. It is not tied to your employer. There are three main types:

Traditional IRA

What’s the tax situation? Tax-deductible meaning you can write off your yearly contribution on your taxes. You then pay taxes on the money when you withdraw it in retirement.

Max contribution: $7000 per year

Roth IRA

What’s the tax situation? These contributions are not tax deductible (meaning you pay taxes on the money and then you deposit it to your Roth account). However, your withdrawals in retirement, including earnings, are tax-free.

Max contribution: $7000 per year

Important to note: You can have both a traditional IRA and a Roth IRA, but your total contributions between the two can’t exceed $6500 per year.

SEP IRA

What’s the tax situation? Tax-deductible (like a traditional IRA).

Max contribution: The benefit of a SEP-IRA is it lets you make larger contributions than a regular IRA. You can contribute up to 25% of your annual business earnings with a max contribution of $66,000.

Important to note: This is designed for self-employed people or small business owners.

Conclusion

Several retirement accounts are available, each with its own rules and benefits. The most important thing is that you get started saving ASAP. Be sure you have socked away your emergency fund and have paid off your high-interest debts, and then do a deep dive into the retirement account that best suits your needs.