In the world of travel hacking, a majority of your points will be accrued via new card sign-up bonuses. However, don’t forget that you can also rack up significant amounts of points by being strategic in your daily card usage. Let’s talk about the role that credit cards play in the management of your household budget.

First things first: Create a budget

To travel hack using credit card points and miles, it’s crucial to first build your financial literacy. And part of becoming financially literate is getting a picture of where your money goes. Let’s take a moment to create a budget.

First, analyze your monthly income and expenses to understand your cash flow—how much is coming in and going out. Review your budget every six months or so to make any necessary adjustments. This way, you can stay on top of your spending habits, reel in spending if need be, and ensure you are achieving your financial goals.

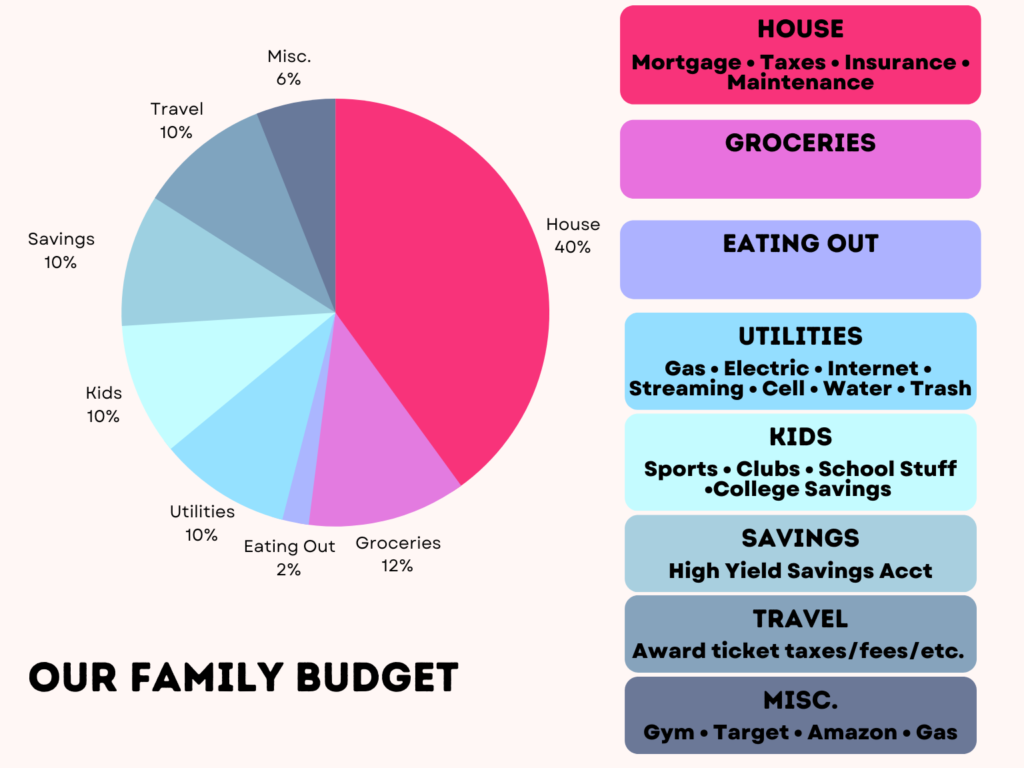

Here is our household budget:

The role of credit cards in your household budget

You may be working on meeting the minimum spend on a new credit card in any given month. If this is the case, all your monthly expenses will go on this card, even if another card could earn you more points per dollar in a bonus category. Your main goal is to hit that minimum spend as quickly as possible.

Unfortunately, your mortgage can’t be paid using a credit card. This is a bummer because it is most families’ most significant monthly expense. It’s okay, though, because there are plenty of other ways to rack up large amounts of monthly credit card miles.

If you’ve successfully met your minimum spending and are taking a break between applying for new credit cards, now is the time to strategically plan which cards to use for specific purchases.

Start by examining your budget to identify where most of your spending goes. Then, build a credit card strategy to earn the most rewards in the categories you spend the most. For instance, 12% of our monthly budget is allocated to groceries. Unless I am working on hitting a minimum spend, all of this grocery spend will go on a card that pays at least 4x at grocery stores. I prefer the American Express Gold Card for this category. Let’s break it down:

Next, analyze another large chunk of your monthly budget. For us, these are utilities and cell phones. I want to be sure to pay for our cable, internet, and cell phones with the Chase Ink Preferred card which pays 5x on all of those categories. We easily generate thousands of Ultimate Rewards points per month this way.

Continue through your monthly budget and decide which card is most appropriate for each of your top spending categories. Do you eat out a lot? You will definitely want the American Express Gold Card, as it pays 4x at all restaurants. My goal is to always make at least 2x on every purchase. I like to leverage big spending categories in our household budget for at least 4x. This adds up!

In conclusion…

Credit cards should play an essential role in your everyday household spend. Look at your monthly budget and identify the categories where you spend the most. This includes groceries, eating out, travel, and utilities for most families. Knowing your spending habits will help you choose a credit card that offers rewards for those specific categories.

You’ll eventually build a wallet of multiple credit cards that offer rewards for different spending categories. For example, you will use one card for groceries, another for gas, and a third for dining out, depending on which card offers the highest rewards for each category. Leveraging credit card spending categories for your daily household spend is a smart way to earn max points and miles quickly and efficiently.