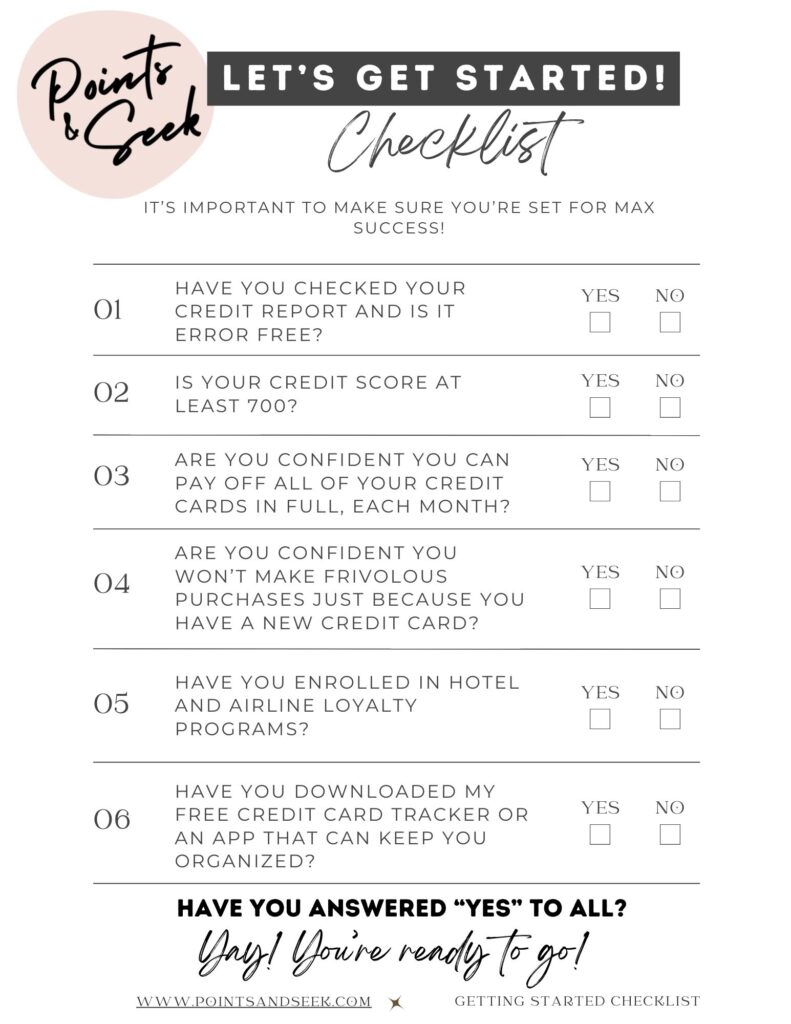

Welcome to the world of points and miles! If you’re anything like me, booking dream vacations without breaking the bank sounds like pure magic. But trust me, it’s not magic—it’s strategy! Organization is key in this hobby, and I want to ensure you are set up for maximum success. To help you begin on the right foot, I’ve created a handy travel hacking checklist that covers everything you need to know to start. Grab it, and let’s start earning points and booking trips!

1) Check Your Credit Report

Every year, you are entitled to a free credit report from the three major credit bureaus – Equifax, Experian, and TransUnion. You can request your free report by visiting annualcreditreport.com.

First, you’ll want to double-check your credit report for any errors that can negatively impact your score. An error isn’t likely, but it’s also not unheard of. Examples of some mistakes are fraudulent or duplicate accounts or misreported payments. Any mistake on your report can drag down your score, and you’ll want to address it ASAP.

Next, you’ll want to check your credit score. The most widely used credit score model in the United States is the FICO score, which ranges from 300 to 850. The higher your score, the better, as it shows banks that you’re less likely to miss a credit card payment.

2) A Strong Credit Score

You need a healthy credit score to be approved for all the good cards with all the good signup bonuses. It’s not the end of the world if your credit score is less than 700. Working towards increasing it will be great practice on your path toward financial literacy. It will take a little time, but once you have strengthened your score, you will be ready for your reward travel adventures!

3) Pay Balances in Full

Remember, the golden rule of travel hacking is to stay debt-free! Don’t dive in until you’re completely free of credit card debt and confident you can keep it that way. Credit card interest rates are sky-high, and carrying a balance would instantly wipe out the perks of any points you’ve earned.

4) No Frivolous Purchases!

Equally important is avoiding frivolous purchases to meet a minimum spend requirement. It can be tempting to splurge on things you don’t need to hit that target, but doing so defeats the purpose of travel hacking.

Remember, the goal is to earn points without overspending. Instead, use your card for everyday expenses like groceries, utilities, and other bills. There are plenty of ways to meet the minimum spend organically without adding unnecessary debt.

5) Enroll in hotel and airline loyalty programs

You will eventually be transferring miles into hotel and airline programs, and it’s helpful to have accounts already established. Creating these accounts is free. So, take a couple of hours one day and list the hotels and airlines you will most likely use. Then, go to their websites and join their membership programs individually.

6) Find a System to Stay Organized

This hobby requires organization. Finding a system that works for you, whether an old-school pen and paper, a spreadsheet, or an app, is essential. I use this worksheet to keep myself organized.

Last but not least…

Have a travel goal in mind! When you’re just starting with points and miles, it helps to have a dream trip as your target. This goal will guide your planning and help you narrow down the best airline and hotel options for your needs.

Plus, it ensures you only apply for cards that align with your travel plans. For example, in my first year of travel hacking, I signed up for a Delta Airlines card because I saw another blogger rave about its high sign-up bonus.

The problem? I don’t live near a Delta hub and rarely fly Delta. I applied for the card without a specific trip in mind, and it took up a valuable spot in my 5/24 count! Having a clear travel goal can help you avoid this mistake.

Ready to Start Applying?!

Have you gone through everything on the points and miles getting started checklist? – YAY!! Now for the fun part! Let’s start applying for cards and booking travel!

My absolute favorite card for beginners is the Chase Sapphire Preferred.