Welcome to the world of points and miles!

I get asked a lot how my family can afford to take so many amazing vacations throughout the year. The short answer is — we travel hack! Travel hacking is the art of leveraging credit card points and miles to book dream trips.

This can initially seem overwhelming or too good to be true. I’m here to tell you that anyone can do it! It requires some organization, some strategy, and a solid financial base. Don’t worry! I’ve created this blog to demystify travel hacking and help guide you through all these things.

So, let’s start turning everyday spending into unforgettable travel!

How do points and miles work?

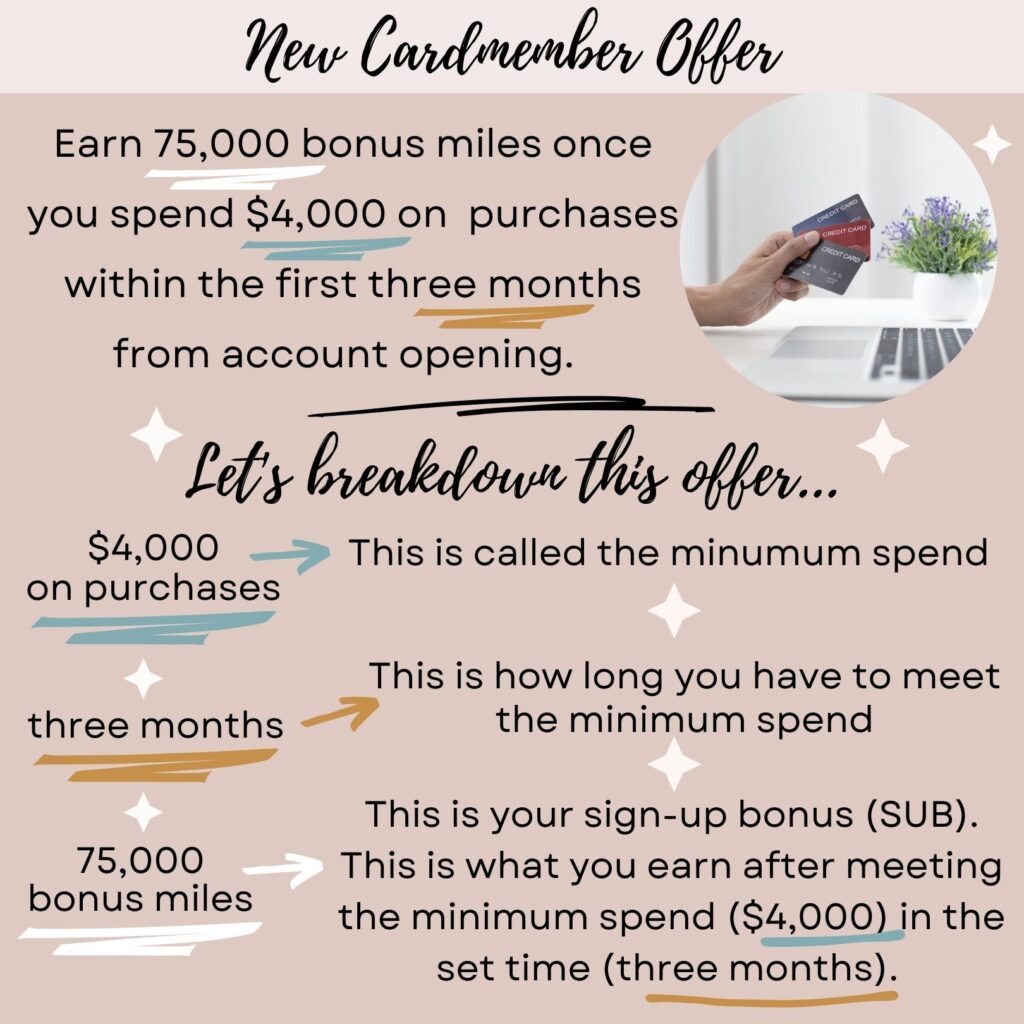

Travel hacking is all about using credit card sign-up bonuses to score free or discounted trips. Banks are eager to have you as a customer, so they offer generous sign-up bonuses—essentially, a large chunk of points or miles—as an incentive. To earn this bonus, you must meet a minimum spending requirement within a specific time frame. Let’s break down what a sample card offer typically looks like:

So, the main idea behind award travel is that you sign up for a new card, meet the minimum spend within the given time frame, earn the sign-up bonus, and use those miles to book a trip! Then, you rinse and repeat the entire process!

Get rid of misconceptions

I hear a few misconceptions over and over:

- Travel hacking is only for people who travel for business: FALSE. While business travelers earn points and miles through work-related expenses, travel hacking is accessible to anyone, regardless of their travel habits or job. Everyday purchases you have built into your household budget—like groceries, dining, and even streaming services—can help you earn rewards just as effectively.

- Travel hacking is only for solo travelers: FALSE. Sure, finding award tickets for one person is much easier than finding tickets for a family of four. But thanks to points and miles, my kids have seen the world! It requires a little more strategy, but it is totally possible.

- Having too many credit cards will hurt your credit score: FALSE. This is the one that I hear the most. I have about 24 open credit cards, and my current credit score is 833. The key is knowing how your score is calculated and ensuring you never carry debt on your cards.

Become familiar with the three types of cards geared toward travel

There are three types of cards you will want to have in your wheelhouse of travel tools:

1. Branded Cards

These cards are branded for specific hotel chains or airline programs, like the Southwest Airlines card, the Hyatt card, and the Alaska Airlines card. They earn points you can redeem exclusively with that airline or hotel chain. You can only use these points for the airline or hotel for which you have the card. For example, you can only use your United points to book on United. You can’t use them to book a hotel room with Hyatt, etc.

2. Transferable Points Cards

I love these cards because they offer the most flexibility. Some examples are Chase and American Express. They earn transferable points you can redeem for travel with different airline and hotel partners. For instance, I can transfer my Chase points to United to make a flight booking. I can also transfer my Chase points to Hyatt to make a room booking. This flexibility makes transferable points cards the absolute best to have. My favorite starter card is the Chase Sapphire Preferred, which earns Chase Ultimate Rewards — one of the most valuable types of transferable points.

3. Travel Statement Cards

These are cards that offer what I call a purchase eraser. An example is the Capital One Venture X Card. When you make a travel purchase using this card, you can “erase” the purchase with points. So, a $100 train ticket purchase in Europe can be “erased” using 10,000 Capital One miles. To this end, this type of card is an excellent option for the parts of travel that aren’t covered by loyalty points programs.

What about annual fees?

Many cards have an annual fee. In short, this fee is what it will cost you each year to keep the card. I know this seems counterintuitive, but these cards usually have perks and benefits that far outweigh the annual fee. Also, it is always worth paying a new credit card’s yearly fee when you’re getting a large sign-up bonus in exchange. At the end of the year, you can decide whether to keep, cancel, or downgrade your card.

Points & Miles 🤝 Financial Literacy

As you apply for cards, you will learn about credit scores, budgeting, and financial responsibility. This is what it means to be financially literate! Credit card rewards and financial literacy depend on each other, and it is such a boss move to handle both successfully.

Is reward travel for me?

It’s hard to express how incredibly rewarding travel hacking is. It allows you to increase your money savviness, strengthen your credit score, AND provide amazing travel opportunities for your family.

Of course, there are some do’s and don’ts you’ll want to follow along the way. Also, some housekeeping checklist items you’ll want to get squared away. Doing this will help set you up for maximum success.

Welcome to the exciting world of credit card points and miles!!