Each bank has its own little “quirks” regarding credit card approvals. Chase is most notorious for its “5/24 Rule.” The basic gist is that Chase will not approve you for a new card if you have opened more than 5 new credit cards in the last 24 months. The five-card limit isn’t just for Chase cards – it applies to all cards.

Let’s say you’ve opened six new American Express cards in the past two years. That means you’re over the 5/24 limit, and if you try to apply for a new Chase card, you’ll be met with a big fat NOPE. This is why it is essential to be strategic in your application strategy. I always suggest applying for Chase cards before moving on to other banks. The basics for understanding Chase’s 5/24 rule:

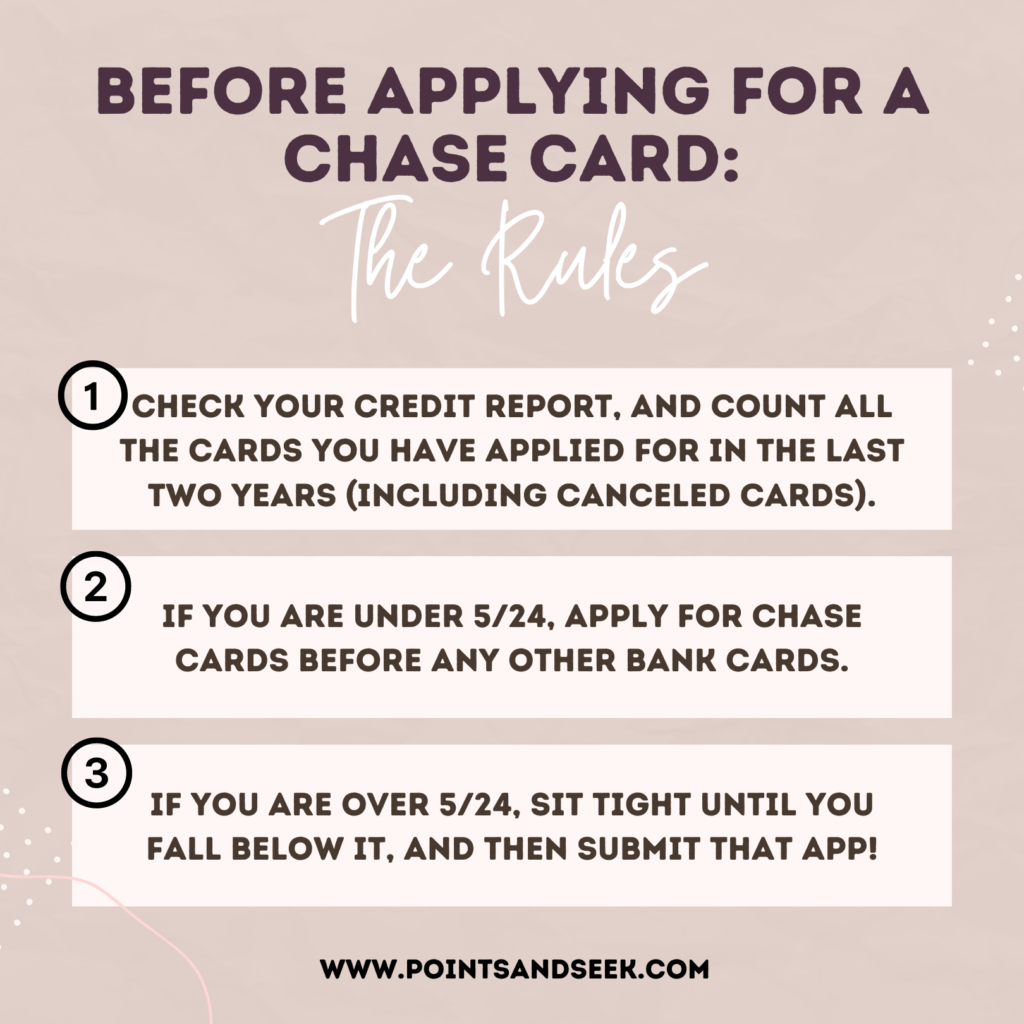

Here is my strategy for working with the 5/24 rule:

- Before applying for Chase cards, double-check your credit report and count how many cards you have opened in the last two years. If you are over 5/24, applying for a new Chase card is not worth it because you will be denied. Checking before applying will save you the ding to your credit score of applying and getting denied.

- If you are over 5/24, check and see if any of those accounts are authorized user accounts. If they are, you can call the bank and ask to be removed as an authorized user. This will then free up a spot in your 5/24 count.

Conclusion

Yes, Chase’s 5/24 rule is annoying, but understanding it is vital to success in travel hacking. It’s a good idea to always have an application plan before applying for cards. Chase’s 5/24 rule will definitely influence what this plan looks like. Be sure to follow these rules and work them into your points and miles strategy: