Travel hacking is all about using credit card sign-up bonuses to score (practically) free vacations. The basic idea is to sign up for a new card, meet the minimum spend within the given time frame, earn the sign-up bonus, and use those miles to book a trip. Then, you rinse and repeat the whole process!

A typical new card spend requirement is usually around $4000, although business cards can be much higher. I generally like always to be working on a minimum spend – this is how I can keep a robust points balance. Let’s go through some strategies I use when I am trying to meet the spending requirement on a new card.

What does a minimum spend offer generally look like?

Banks are eager to have you as a customer, so they offer generous sign-up bonuses—essentially, a large chunk of points or miles—as an incentive. Let’s examine what a sample card offer typically looks like:

It’s essential to be sure you have a plan for meeting the minimum spending requirement for a new card in the allotted time. Because, honestly, there would be nothing more tragic than getting a new credit card and falling short of earning that sweet, sweet sign-up bonus. So, what are some ways I like to meet the minimum spend requirement on a new card?

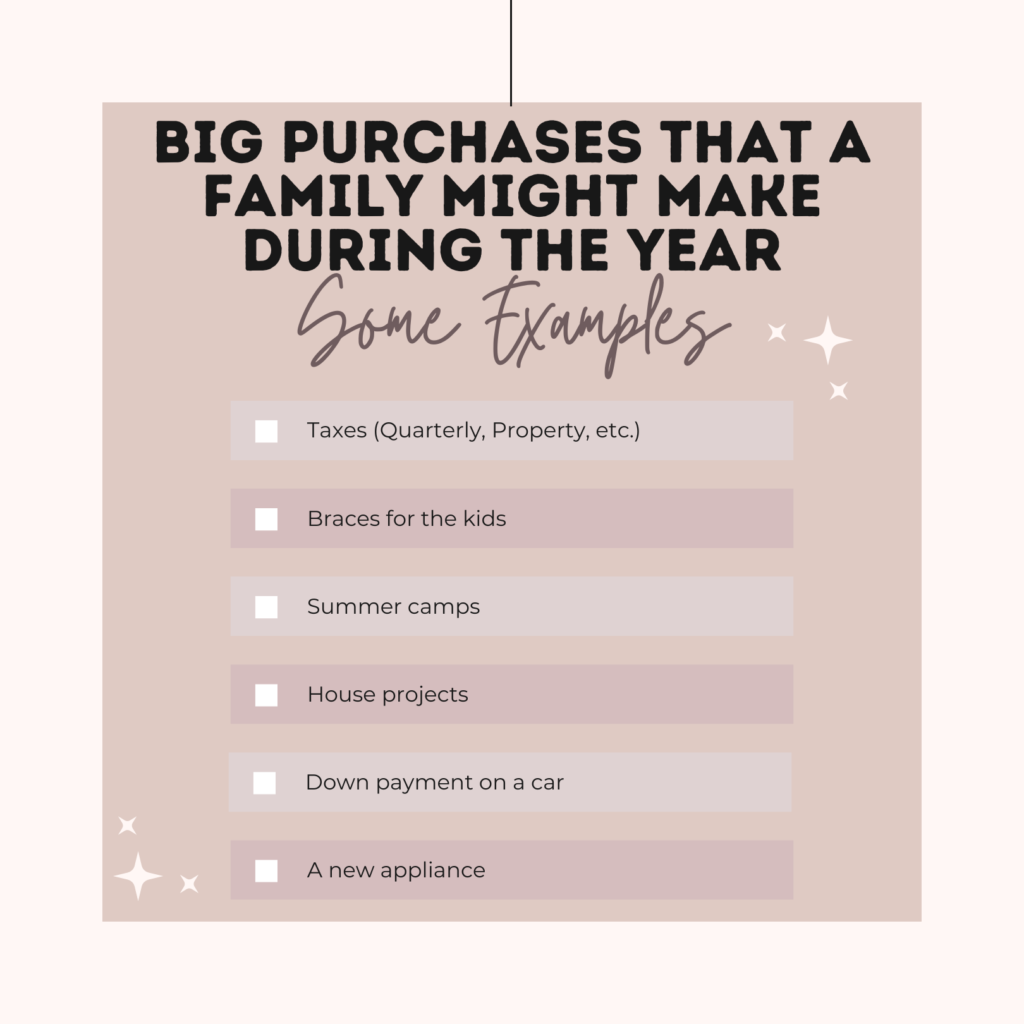

1) Time your big purchases

I like to plan big purchases around new cards so that I can use them to meet my minimum spend. Here are some examples of big purchases families may encounter throughout the year:

Last year, we had the ultimate double whammy. My son needed braces, and our fridge started acting up. I opened a new card for each of these big purchases and knocked out the bulk of the minimum spend in one swipe. Are you due for a new car? Most dealerships will (begrudgingly) allow you to charge up to $5000 of your downpayment to a credit card.

It’s important to note that some purchases (taxes, for example) charge a convenience fee (typically ~2%) if you pay with a credit card. If I am working on meeting the minimum spend on a new card, I will happily pay that 2% if it quickly and easily gets me a large sign-up bonus.

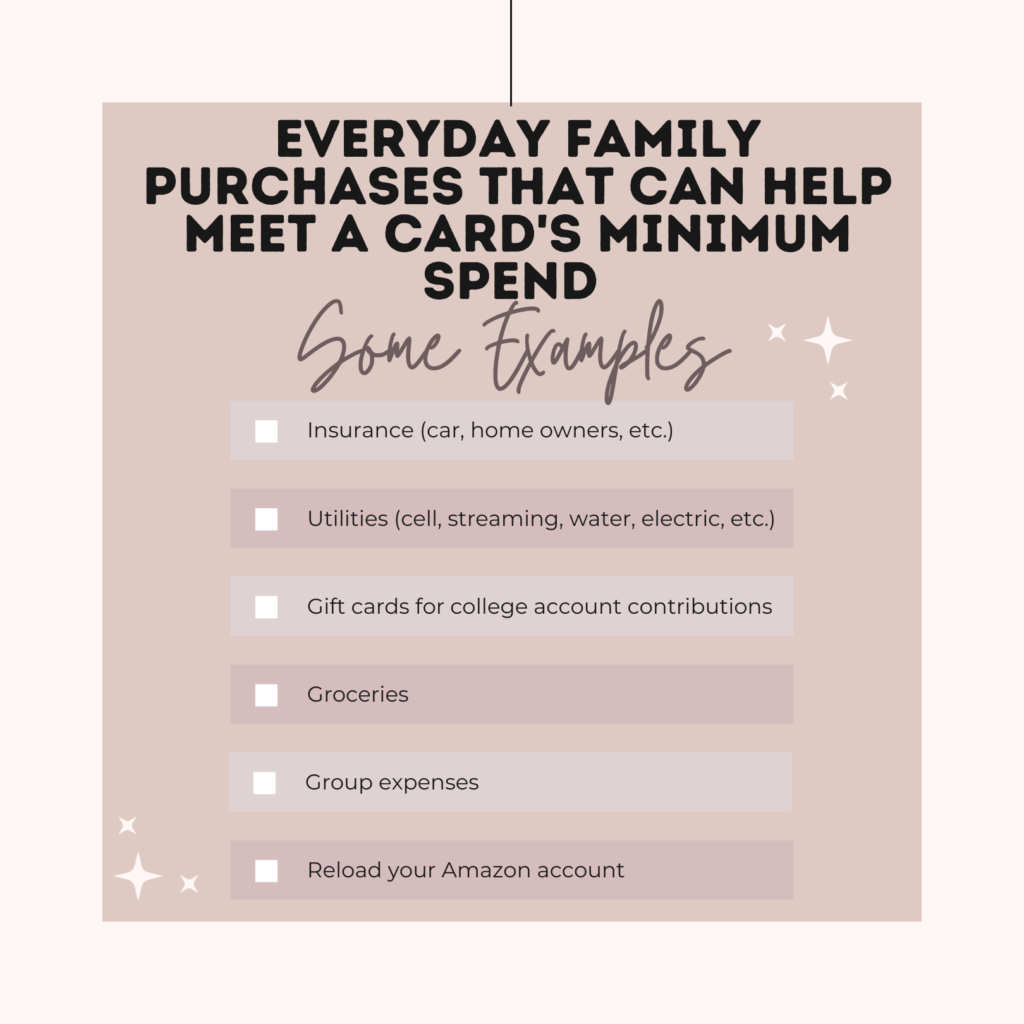

2) Transition your everyday spend to your new card

In addition to making large purchases, it’s also important to review your budget to be sure you are paying as many monthly expenses as possible with your new card.

- Bills—When trying to meet a minimum spend, I take an hour or so to update my automatic bill payments. Cell phone, internet, car insurance, utilities—you name it, and I update it! I switch the payment method on these accounts to my new credit card to ensure I’m progressing toward meeting the spending requirement. Is it a hassle? Meh, yeah, kind of. But it’s a straightforward way to chip away at that minimum spend.

- College Account Contributions—Monthly contributions to our boys’ 529 college accounts are set up as autopay on our checking accounts. However, if I’m sweating meeting the minimum spend on a new card, I will pause those checking account transfers and purchase gift cards from giftofcollege.com. I will purchase these gift cards with my new credit card and deposit them into our 529 accounts.

- Groceries—Don’t forget this huge monthly expense! We easily spend $1000 on groceries per month. I will always put this expense on whatever new card I am working on.

- Group Expenses—Another trick is to offer to cover others’ expenses. For instance, whenever I do a Costco run, I will ask friends and family if there is anything I can pick up for them. I put it all on my credit card, and they reimburse me. This also works for large dinners out. When my friends and I have a girls’ night out, we find it more convenient to charge the entire bill to one card. Then, we all Venmo that person. You better believe I am the first to volunteer my card for the whole tab. This is such an easy way to accumulate spend on a new card.

- Amazon Reload—Lastly, if I am nearing the deadline for hitting the minimum spend on a new card, I will use that card to reload our Amazon account. We will spend this sooner rather than later, so it’s a no-brainer for me.

One Important Rule

Do not, I repeat, DO NOT make frivolous purchases just to hit the minimum spend on a card. This is just bad money sense. And that is not the vibe we are going for.

In conclusion…

Travel hacking is a simple concept – get a new credit card, spend a certain amount to earn a big sign-up bonus, and then use those rewards to book a trip – easy peasy! Make sure you plan how you’ll meet the spending requirement before applying for a new card. It’s always clutch to time a new card around a big purchase you plan to make. If you don’t have any significant expenses coming up, be sure to use your new card for every single monthly bill and expense you can think of. Then, sit back and start banking those big sign-up bonuses!