Many credit cards with good sign-up bonuses also carry an annual fee. I understand that paying a bank to use their product feels counterintuitive. However, it’s important not to count out cards with annual fees. Why is that? Well, these cards generally carry perks and benefits that outweigh their costs. That said, it’s also important to reassess these cards every year to ensure they still serve you and you are still getting maximum value out of them.

Here’s what to do when that annual fee comes due:

First, assess the perks

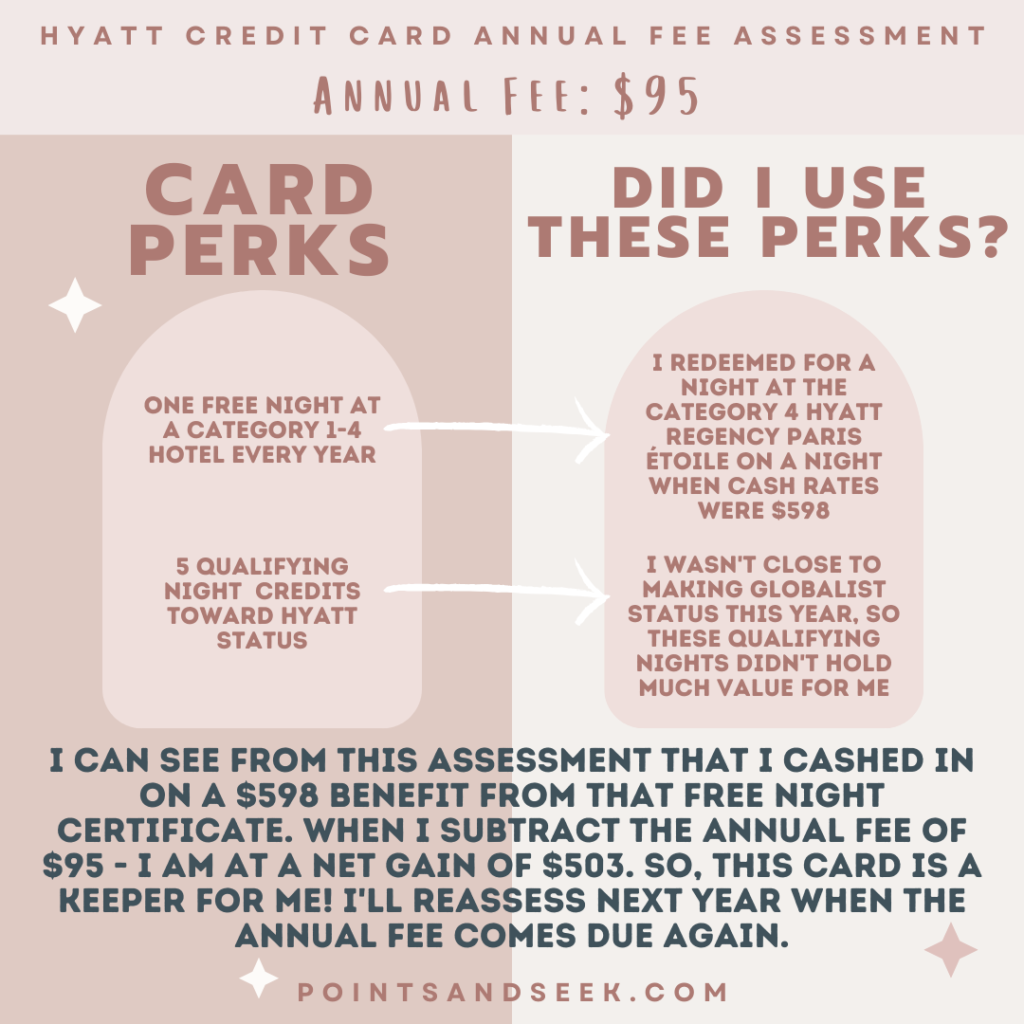

- I list all the perks the card offers and the perks I have used in the past year. A card can carry all the fanciest benefits in the world, but if you aren’t using them, it doesn’t matter.

- If the benefits I received from the card over the past year are greater than the cost of the annual fee, I happily pay the fee and keep the card for another year.

Here is an example of what this calculation looked like for me when I was trying to decide whether to keep my Hyatt card open for another year:

What if you find the perks aren’t worth it?

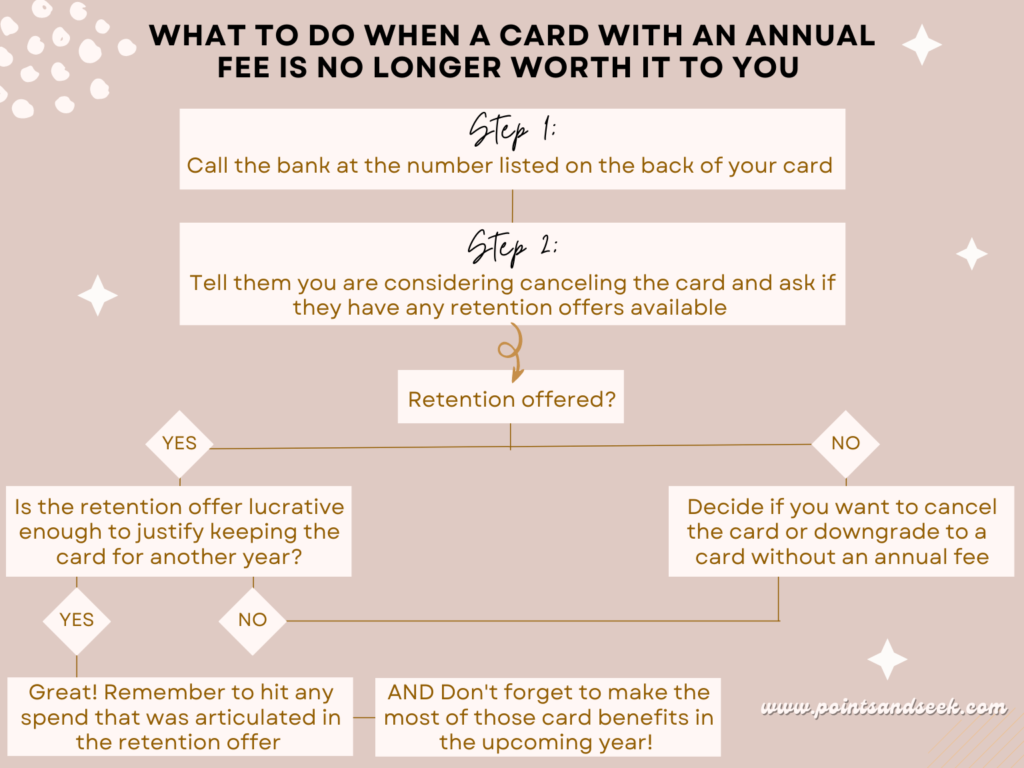

Sometimes, I do this assessment and find that the benefits of the card do not outweigh the cost of the annual fee. In this situation, I do the following:

What is a retention offer?

Many times, banks propose a retention offer to entice customers to keep the card rather than cancel it.

Retention offers can come in a couple of different forms. The first is a statement credit meant to offset the annual fee cost. In this case, the bank would ask if you would be willing to keep the card for another year if they credited your account with XX amount of dollars.

Another common retention offer is receiving points in exchange for spending. For example, the bank might offer 30,000 American Express Membership Rewards points after spending $3,000 within three months in exchange for keeping your card open for another year.

It’s important to note that you might not always get a retention offer. I’ve found that Amex is far more generous with them than Chase. If you are given a retention offer, it’s up to you to decide whether you want to take it. You can accept the offer, but remember you are agreeing to keep the card open for at least another year. If you decide the offer isn’t lucrative enough to keep the card, you need to decide if you want to cancel or downgrade the card.

How do I downgrade a card?

Some (but not all) cards have a no-annual-fee option that you can downgrade to. For example, the Chase Sapphire Preferred card can be downgraded to the no-annual-fee Chase Freedom Flex card. Remember that credit history makes up 15% of your credit score, and if you close a card you have had for years, this will temporarily ding your credit score. So, downgrading is an excellent option if you have had the card for a while.

How do I cancel a card?

If you decide to cancel a card, there are a few steps you should follow:

- Be sure the card has been open for at least a year. If you cancel a card before your year anniversary, the bank can and will take back any sign-up bonus you had earned.

- Be sure your balance has been paid in full. This is rule numero uno in the reward travel biz, so hopefully, you are not carrying a balance. If you are, make sure to pay it off before canceling.

- SAVE THE POINTS! This is VERY IMPORTANT!! Airline or hotel points earned on a branded card are safe even if you cancel the card. However, you can lose points earned on a transferable points card or a travel statement card if you cancel the card before making sure the points are safe. The points are made safe by transferring them to a hotel or airline program or a different card held by the same bank. For example, let’s say I decide to cancel my Chase Sapphire Reserve card. I would first want to move all of my points to either my husband’s Chase account or to one of my other Chase cards that earn Ultimate Rewards points. Otherwise, I will lose them when I cancel my card.

In Conclusion

The benefits that credit cards offer often far outweigh their annual fees. But, what to do when that annual fee comes due? It’s essential to reassess these cards every year to ensure they are still working for you and that you are maxing out their perks and benefits.